For more than 10 years we’ve been hearing about the competition that will come after Tesla, but all registration data and facts we have prove that’s simply not true.

Every year, every month, every week, and every day, the same mantra is endlessly repeated: legacy automakers or even new incumbents with battery electric vehicles (BEVs) will grow faster than the Californian challenger as if a repeated claim without facts backing it up will somehow one day become reality. It’s a mantra that doesn’t seem to die, even though all the facts speak against it with each passing month, quarter and year.

Facts that the industry, the media, and the general public like to overlook, disregard, misread or intentionally ignore. This article will attempt to explain why it was apparent early on that there was no competition to Tesla in the past, that there is none today, and that there will be none in the foreseeable future for three simple reasons. These three reasons will explain why and the data shared in this article will confirm that anyone still waiting for the competition to come after Tesla will be waiting for a long time if not forever.

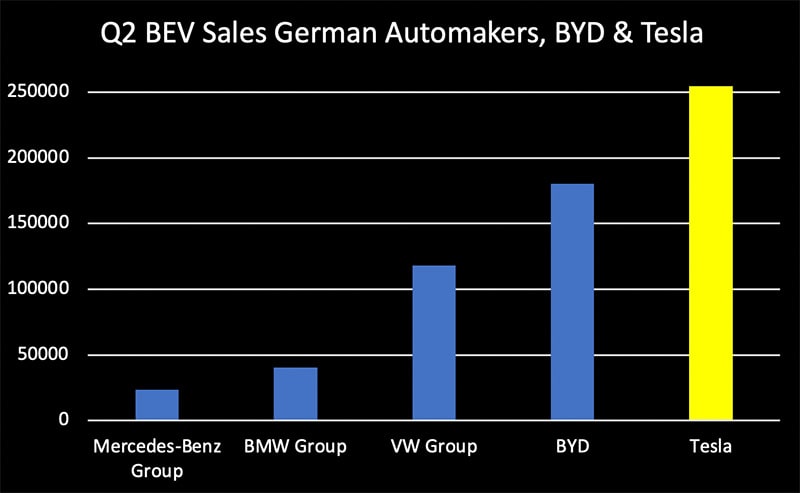

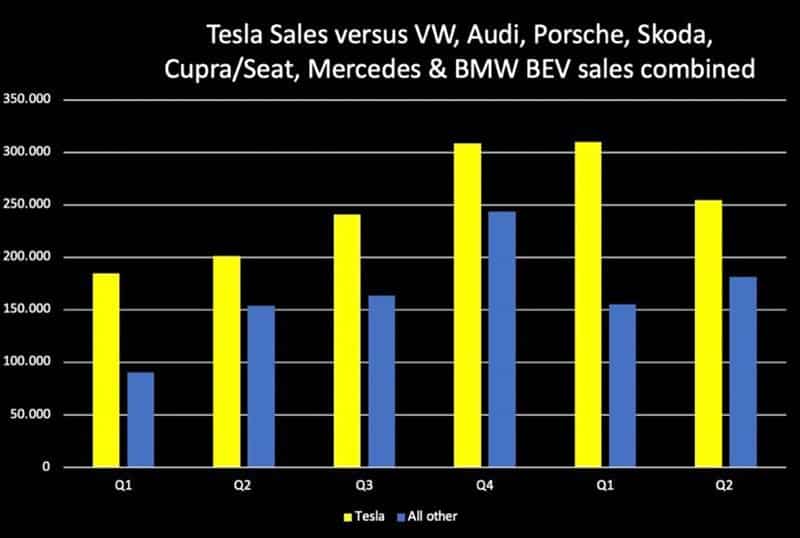

With 3 million battery electric vehicles now delivered, Tesla is the company that dominates the present and electric future of the mighty automotive industry, not only in terms of units sold but also in terms of revenue, profit, and margin. Despite supply chain challenges and Covid-related production shutdowns in China, Tesla is the company that has shipped the most BEVs in the last 12 months and the second quarter of 2022. All of the German automakers combined are smaller than Tesla in terms of BEV units sold, revenue, and profit, regardless of whether we look at the brand or group’s data BEVs.

Even more importantly, Tesla is also the fastest growing company in terms of units shipped, sales, and profit margins, indicating that the gap between the competition and Tesla is widening, not narrowing in the future as many predicted. Today, Tesla makes a profit of €10,360 per vehicle sold, while its often-mentioned German rivals, Mercedes-Benz earn €8,770, BMW €3,965, and Volkswagen €3,373 per vehicle. The Volkswagen Group, whose CEO declared in July 2022 that he wants to overtake Tesla in 2025, makes only a third of the profit per vehicle sold and that is a dramatic difference to VWs capability to compete and keep up in the near future. The same is true for U.S. automakers Ford, GM, or Asian manufacturers like BYD. They all have the structural disadvantage of either having an ICE business that they want to keep as long as possible to keep their operations financed or a regionally dominated ICE customer base which narrows their global market leverage.

The three main reasons why the competition is not catching up to Tesla are software excellence, battery supply, and pace of innovation. Each reason alone is hard to combat, but the bundle is invincible.

1. Software Excellence

Software is like the blood in our veins that carries information to every single cell in our body. If you only supply blood to parts of your body and not all cells receive it, we wouldn’t expect them to function properly, would we? What is true for our bodies is also true for vehicles. They simply don’t function as intended if parts don’t have a direct connection to our brain or to a central computer but are isolated. The legacy car manufacturers didn’t design their vehicle hardware and IT infrastructure to communicate with all the necessary parts of the vehicle, which is just one reason they fall short of what a Tesla can do.

Another reason is that legacy automakers are led by executives who succeeded in a world where internal combustion engine sales and combustion drivetrain performance was critical and a differentiating factor. Today’s top auto executives are literally incompetent in the world of BEVs that are mainly driven by software and should have been fired a decade ago. An automaker that wants to catch up to Tesla needs to be more of a software company than a hardware company but all the top executives of the legacy automakers are trying to avoid this change attempting to cover up their incompetence. No matter how important it is because they know they will have to leave the company to make room for competent executives with software backgrounds to make it work.

Unlike the large traditional car manufacturers, many small startups have well understood the challenge of mastering software excellence. Many features that customers expect are available in their vehicles because they have learned from Tesla that this is possible if they organize themselves accordingly from the beginning. Startups have a much better chance of gaining market share than incumbents, and if they can overcome the challenges of scalability and manufacturing, they have a better chance than legacy big brands.

2. Battery Supply

When Tesla announced its plan to build the world’s largest car battery factory in the Nevada desert in 2014, the entire industry laughed at Elon Musk. A few years later, they all stopped laughing and today deeply regret their reaction and decisions and that they did not follow Elon Musk’s example in 2014. Today, eight years later, the entire automotive industry lacks an adequate and critical supply of lithium-ion batteries for their BEVs, and that battery shortage will not go away in the current decade as demand grows faster than supply capacity is built.

The exponential growth of one of the world’s largest industries is difficult for top executives accustomed to a century-old, slow, and steady-growing auto industry to comprehend and adapt to. Their inability and lack to foresee the future is further evidence that they are not fit for the job. Executives today claim that low BEV shipments are not their fault because they are caused by suppliers who cannot deliver the critical component, but what they should have done, and are doing, is building their own battery supply chain network – a monumental task that will take decades, but is essential for survival.

Do we really need to tell automaker executives that you can’t build a single battery-powered electric vehicle without batteries? Many automakers sell millions of vehicles but don’t have the capital or profits to make their own cells and all that can’t are at the bottom of the food chain. Tesla, the small electric car maker from California that didn’t get the required supply allocation in 2010 because no one believed in its vision and the exponential growth of battery-powered electric vehicles, is now at the top of the food chain. While the entire industry assumed that their Tier 1 to Tier 3 suppliers would take the risks Tesla took to produce batteries in anticipation of exponential growth, automaker executives made serious strategic mistakes for which they should be held accountable. The longer it takes to hold them accountable for the serious mistakes they made, the less likely automakers are to succeed in the future or to survive.

3. Pace of Innovation

Elon Musk’s response to one of my articles years ago that “all that matters in the long run is the pace of innovation” is wisdom that no old automaker seems to have understood.

A company that is unable to accelerate its innovation and iteration of products has lost its ability to survive in a world where a company like Tesla is driving customer demand. Innovation in batteries and software is what the future of the industry is all about, but rather than owe it to themselves, legacy automakers have outsourced software and batteries to suppliers who have very different business objectives. A supplier wants to make sales with an established and mature product on which it can optimize its production costs and profits while reducing any risks associated with new innovations to a minimum. After 100 years of experience, one would expect managers in the automotive industry to understand this simple fact, but instead, they relied and continue to rely on a supply network that has different goals than the manufacturers in a time of a rapid transition to BEVs.

Until the auto industry gets a handle on battery supply, software superiority, and the pace of innovation, we will see it fall further and further behind the dominant market leader, Tesla. This trend will continue until the first legacy automakers consolidate, merge or go out of business. At the end of this process, Tesla will likely claim the majority of profits and +50% of industry revenue, while becoming an even more dominant provider of autonomous technology in vehicles and robots. Artificial intelligence is already a part of their vehicles. All they do now is to expand that service which allows Tesla to gain profit margins of more than 80%. A number that has never been seen before in the automotive industry.

In the past, we have seen Tesla grow by more than 50% year after year, while incumbent automakers continue to shrink their overall sales but sell mediocre products and lack supply, production capacity, and innovation. It is already known that these scaling issues will not go away easily or quickly, so it is safe to predict that Tesla will widen the gap between itself and its competitors. This will help the U.S. automaker to extend its lead, and it will become more difficult for incumbents to retain their existing customers or even win back former customers. All these signals point in the same direction, and it doesn’t look good for the car brands we grew up with in our childhood.

I warned the world back in 2015 about what would happen to Tesla in 2022, and I’m warning the world now about what will happen to them in 2030.

Don’t tell me later that I didn’t warn you about what is happening!

About the author

Alex Voigt has been a supporter of the mission to transform the world to sustainable carbon free energy and transportation for 40 years. As an engineer, he is fascinated about the ability of humankind to develop a better future via the use of technology. As a German, he is sometimes frustrated about the German automotive industry and its slow progress with battery electric vehicles which is why he started to publish in English and German. With 30 years of experience in the stock market, he is invested in Tesla [TSLA], as well as some other tech companies, for the long term.