When I wrote my first article about the German auto industry almost 4 years ago in spring 2018, I didn’t dare publish it for six months because my predictions were bold and went against public and industry opinion. I rang the alarm bells and painted a black picture of the future of the auto industry in my home country of Germany, but few listened.

The goal of the article was to make auto executives aware that Tesla is an expression of a fundamental technological transformation and that their companies will shrink, be bought out, or face bankruptcy if they don’t change course quickly. When I published my bold predictions, I was not sure what would happen, and the overwhelming response I received from the audience was negative. It took many years for people to change.

Today, 4 years later, at the end of 2021, I am shocked and saddened that my worst nightmares have come true. The German auto industry has been and continues to be in decline at all levels, as evidenced by shrinking sales figures, constant restructuring, and company spin-offs: A consolidation of the auto industry has begun that will forever change everything we thought we knew. In this article, I will analyze the situation and make predictions for the future using the VW Group as Germany’s most important car manufacturer as an example.

In the past decade, the automotive industry and the Volkswagen Group have done almost everything wrong that can be done wrong in a technological transformation. First, they ignored battery electric vehicles, then they ridiculed them, then they fought them, then they tried to copy them, and then they lost. Not only did management recognized the situation they were in too late, but also, they didn’t fully understand it until today. Huge and still increasing investments in BEVs have not led to the expected sales figures because the foundations of the transformation have not yet been understood, but has only been declared as another powertrain, a form of ‘digitalization’, or ‘electrification’ .

The strength of what was once the world’s largest automaker, with 11 million vehicles in sales, 119 factories, 670,000 employees, hundreds of models, and 40,000 suppliers, became VW’s greatest weakness within just a few years. The VW Group’s scale killed its agility and, with it, its speed of innovation. The question is not whether they can transform at all, but whether they are fast enough. After everything we have seen in the last 4 years, we have to conclude that they are not. The next opportunity to unveil a truly new vehicle innovation is not today or a year from now, but 5 years from now when the new Trinity and Artemis BEVs are delivered, which VW’s marketing message says will make everything ‘better’, ‘faster’ and ‘cheaper’. Time is the VW Group’s biggest enemy today, and they have yet to understand this simple fact.

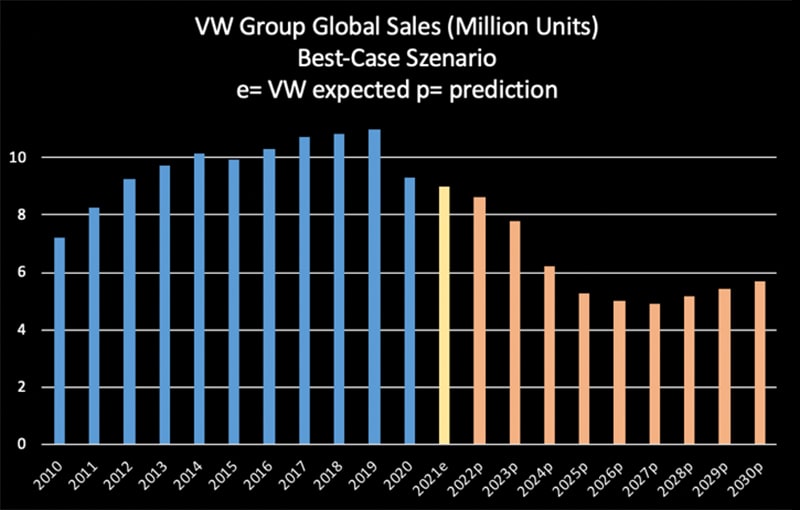

Volkswagen’s ICE sales have been shrinking for the past two years, from 11 million vehicles delivered to a projected 9 million in 2021, and I predict the decline will accelerate dramatically over the next few years. The loss of 2 million vehicles per year is equivalent to the size of the BMW Group and is a sharp decline in a short period. It doesn’t matter if this decline is due to a chip or parts shortages or falling demand because the 2 million vehicles VW didn’t sell won’t come back in the future – they are a thing of the past. All VW can do is sell what they have, which is VW IDs, Audi e-trons, and the like, made on the MEB platform, which has proven to be uncompetitive when it comes to software and battery technology and production speed.

With ICE sales shrinking faster than BEV sales growth, the company is losing not only revenue but profits, as price increases for an uncompetitive and inferior BEV cannot be realized. The competition is not just Tesla, Asian and Chinese BEVs that are coming to market. These companies are nimble, and their vehicles cost less.

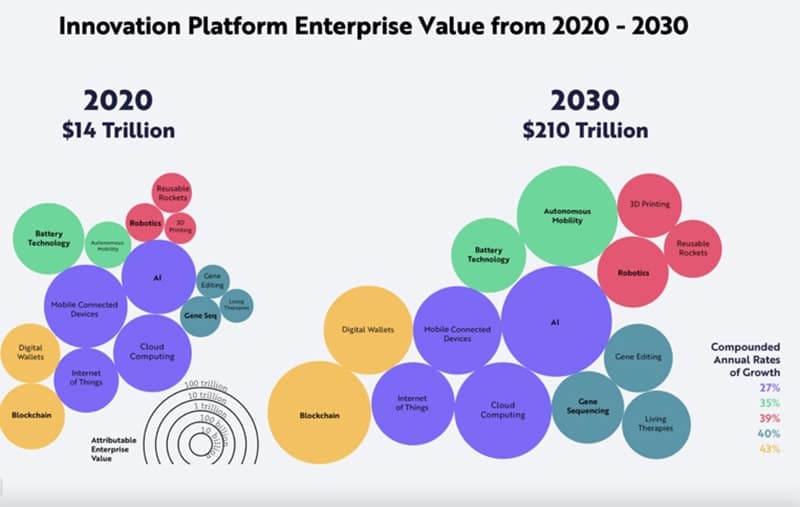

The biggest areas of innovation today are in autonomy, batteries, and software, 3 key areas of strategic importance where Volkswagen currently, has nothing attractive to offer. With the enterprise value for innovation growing 35% to 40% a year from $14 trillion to $210 trillion according to Ark Invest Analysis, any company that can’t deliver in the next few years will shrink or disappear.

If an automaker is not able to be attractive in these three key areas of innovation, that are set capturing a trillion-dollar market, it is unlikely to be a major player in the future auto industry. Even if VW Group can deliver something worth showing in the next 5 years, the others will have taken it all because consumers will decide with their wallets in the next few years and are unlikely to wait.

Investment announcements by the big car companies are piling up and intensifying e.g., GM $35bn, Daimler €60bn, Stellantis $30bn, Nissan $17bn, VW Group €159bn, but they are too late and they’re too big to have these sums make a decisive difference. All of VW’s battery technology investments announced today won’t have an impact for at least 2-5 years. VW’s software group Cariad, which is supposed to become bigger than SAP, is poorly organized due to its substantial size. Tesla has achieved more, with only 300 outstanding software engineers, selling the best vehicle software on the market today, in contrast, VW Cariad and planned 10,000 employees have produced quite the opposite.

These days you cannot win a rapid technology transformation by just throwing capital and people at it, hoping for the best results. A smart investment is better than a large investment.

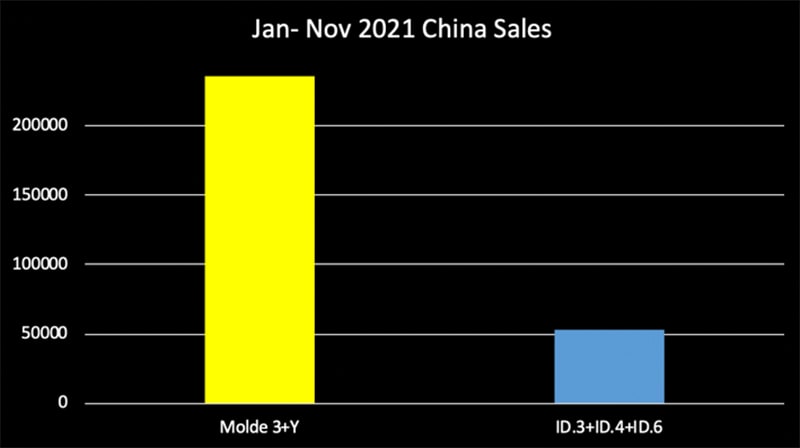

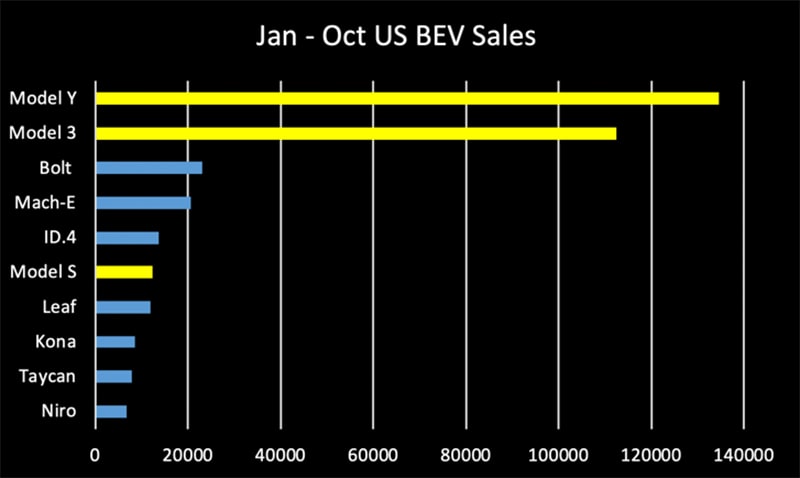

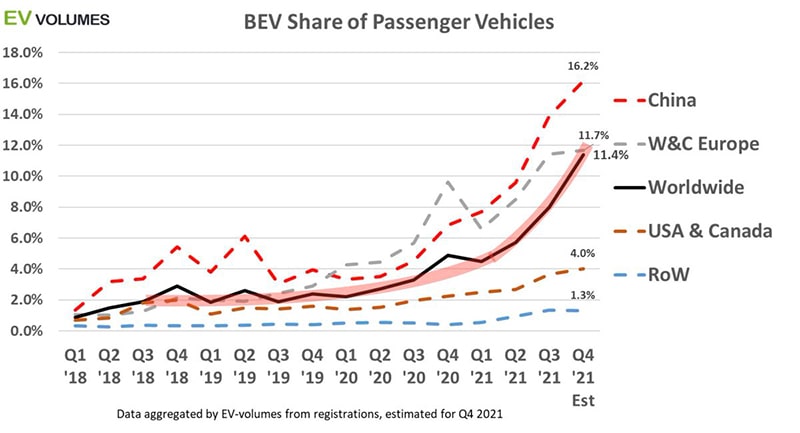

The Chinese VW market, with 40% of total sales, prefers BEVs from Tesla, Nio, BYD, Great Wall, and other manufacturers that understand the software and how to interface with customers. The US market, which was once a key market for VW, has already been lost to Tesla, which accounts for 69% of EV sales from January to October 2021. We’ve seen in Norway, 91% of sales are electrified plug-in vehicles, leaving only 5% for internal combustion engines. Even in Germany, BEVs accounted for 20.3% of all new registrations in November 2021, meaning it’s only a matter of a few years before the trend will hit Europe as well.

At the current moment, VW still has good BEV sales in Europe because the U.S. and Asian manufacturers are prioritizing their home markets for deliveries, this is likely to change from 2022: Tesla is opening a factory in Germany that will eventually deliver 2 million BEVs a year, Rivian is currently in negotiations for a factory in Europe, and many attractive Chinese BEVs such as Nio and Polestar are also entering the European market. Tesla already has a massive productivity advantage, taking them 10 hours to produce the Model 3 in China, compared to an ID.3 produced in 30 hours in Germany. Productivity is key to cost, profit, and output, allowing it to manage demand better than anyone else with dynamic pricing.

Looking forward, it’s unlikely the Volkswagen Group’ situation is going to get better soon, and if they don’t act now, at all.

I predict their vehicle sales will shrink (in a best case scenario) to 5 million units worldwide in 2026/27. Even this, is a devastating decline from their peak vehicle sales by 50%. The scenario presented by VW Group CEO Herbert Diess of 30,000 layoffs (at the Wolfsburg plant alone), if the Trinity project does not prove to be a game-changer, will result in more than 100,000 to 200,000 total job losses in the VW Group: About 30% of all 670,000 if the new BEV platform does not achieve expected results.

Since VW is 20% owned by the state of Lower Saxony and VW is a systemically important company, a massive influx of taxpayer money can be expected to secure these jobs. The capital may help in the short term, but it will not improve consumer demand, meaning the inevitable truth of layoffs and plant closures will only be delayed. VW will continue to sell ICE vehicles in Asia, Africa, and South America, but even those markets will switch to BEVs because the cost of renewable energy is much lower and the total cost of ownership for a BEV is now massively more attractive compared to an ICE vehicle.

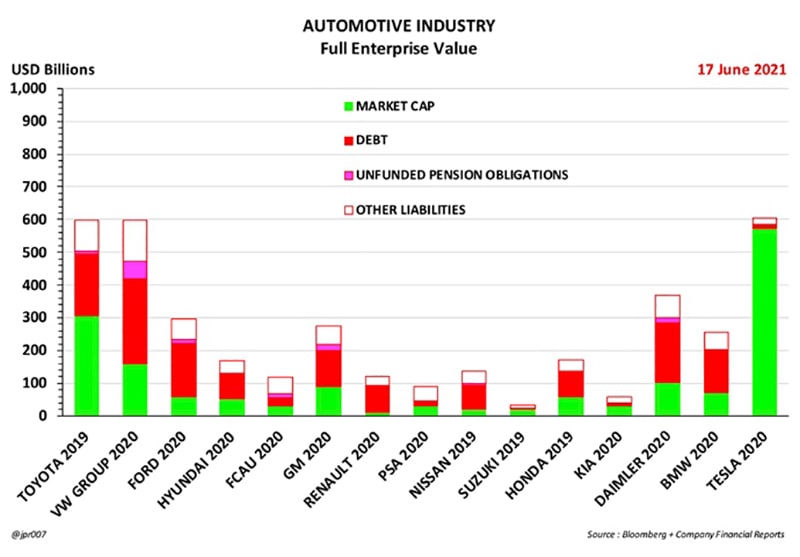

The Volkswagen also has the highest debt of any automaker at $260 billion, and $50 billion in unfunded pension liabilities. The group is financing itself through the European Union, which has bought, and is buying every month, a huge amount of VW bonds. Group management cannot make decisions on production plants, models, and numbers without the approval of the union-influenced workers council, and the recent €159 billion 5-year investment was even decided without the presence of VW’s group CEO, but instead with workers council head Daniela Cavallo. This special VW law, enacted by the German government and endorsed by the EU, places the automaker in a political structure that is unique in the world. It is fair to say that the VW Group is not a shareholder-owned company, but a political organization whose main purpose is to keep an automotive industry and its jobs alive, funded by political goodwill and taxpayer money. The VW Group poses a systemic risk to the German and European automotive and machining industry always being declared as “too big to fail”.

The VW Group’s unique structure and political influences work perfectly as long as there is demand for its vehicles, and that is its “Achilles heel.” It doesn’t matter if VW Group demand is down due to chip or battery shortages, or if people are waiting for a compelling VW BEV, what matters is that VW deliveries are down. What VW has not been able to deliver in the past, for whatever reason, will not be possible in the future. Those revenues and profits have gone to other automakers or have been consumed by other investments. As soon as deliveries and sales start to decline, the structure in which the German and EU governments financially support the company to keep jobs and the industry alive will collapse like a house of cards. VWs deliveries have been falling since 2019, and according to workers council head Cavallo, who can talk to the media without VW’s PR and marketing filter, things will get worse in 2022 and even 2023.

Cavallo talks plain truth: “The coming months will be tough, we have a real lean period ahead of us. There will be bottlenecks next year as well, and in 2023 things won’t suddenly get better. The worst is still ahead of us.”

In recent months, VW Group vehicle sales have declined year-on-year -1.7% based on a weak 2020 and 31.5% in November alone. If Cavallo’s statements are true, then we should see a sustained vehicle decline at least over the next 2 years initially and a bottoming out in the mid-decade years thereafter, assuming the Trinity and Artemis BEV platforms are a big success.

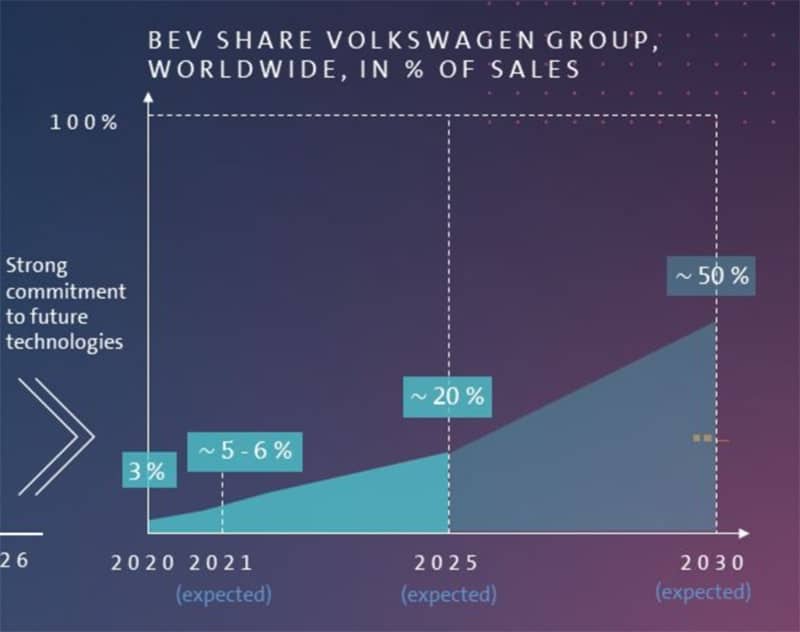

VW announced that they expect in 2021 to sell 94% ICE, in 2025 80%, and in 9 years still 50% which of course includes continents like Africa and South America who are lacking behind with adopting BEVs. Because of the low total cost of ownership of a battery electric vehicle and its superior drive behavior, many predict that in 2025 only 10% of ICE sales will remain and almost none in 2030 depending on the market. Many are surprised that Norway is already above 90% BEV and history has shown that in a technology transformation the process is always accelerating. Globally, BEV share is growing in an exponential “hockey stick” curve and this trend is likely to accelerate. If Volkswagen is planning on a BEV share of just 20% in 4 years, and we see the market at 11.4% worldwide today, then VW will inevitably fall behind the market growth in the last growth area remaining. Assuming the BEV trend remains just linear, a global BEV share of 20% will be reached within the next 12 months while VW is at about planned 8%. Even Germany, a country known to be reluctant to adopt new technologies, reached a BEV share of 20.3% in November.

My prediction for the Volkswagen Group includes many variables and it may be wrong, but it is a future I consider as a conservative scenario. 2025/26 will be the year when VW Group deliveries are significantly lower up, to a third of what they were in 2019, and they may then stabilize and recover slightly from that level. If the Group will survive such a dramatic revenue drain needs to be seen but we can expect that at the start politicians and the German Government will bail Volkswagen out keeping their voters happy.

But if I’m completely wrong and the Volkswagen Group does a much better job of scaling production and bringing compelling BEVs to market en masse, wouldn’t that change their future significantly? The inconvenient truth is that the future for legacy automakers could be even worse than what I’ve described. Imagine what will happen if Tesla gets approval for its FSD software for autonomous driving in 2022 or 2023 and starts licensing it? FSD’s recent progress has been impressive, to say the least, and within a 2-year time horizon at the latest, it’s realistic to think they’ll be able to solve the final challenges.

Wouldn’t everyone who buys a car like to have software that lets the car drive itself and allows them to pursue other activities, be it surfing the web, playing with the kids, or preparing for the next meeting? Volkswagen and all the other established automakers are nowhere close to offering an autonomous driving solution that works in all weather conditions and on all roads at a low cost nor is their approach successful because of missing real-life data and other technical shortcomings. Already today, FSD-Beta drives people in the US everywhere for hours without intervention and successfully in all conditions. Why wouldn’t someone want such a car? Software eats the world, and if there’s one thing Volkswagen isn’t, it’s a software company like Tesla.

My prediction will apply to all legacy automakers in different degrees, depending on how quickly and successfully they can bring competitive and attractive BEVs to market. Some automakers will not survive the cash flow drain and shrinking sales volume and will merge with others, be bought out, or simply go out of business.

With the highest debt in the industry and pressure on BEV margins caused by 200% lower productivity than Tesla, profits, which look good at the moment due to price increases, will drop significantly. Even if VW succeeds in building a new Trinity factory in Wolfsburg by 2026, it is unrealistic to increase productivity in 2026 from 30 hours per BEV produced to the industry-leading standard of 10 hours that Tesla has in Shanghai. If to achieve such a productivity increase is so easy VW would have done it already.

As a measure to rescue the company and to finance its 5-year €159 billion investment plan, VW must take Porsche public and sell the group’s main profit generator through shares at the stock market or to the families. A Porsche IPO is welcomed by VW’s major shareholders Porsche and Piech and by Porsche itself and therefore likely.

As a large automaker, you can’t compensate for your past strategic mistakes, but Volkswagen has the opportunity to survive as a smaller company supplying ICE to countries that lag with BEVs behind. If they can find a niche in BEVs for a smaller segment of customers willing to compromise on technology for the good of the VW brand, look and feel, they could keep sales and not be in existential jeopardy. Over time, most legacy automakers will be a shadow of what they were, licensing technology from Tesla and Co. to make low profits.

Volkswagen will not be the world’s largest or second-largest automaker and that is bad for Germany and Europe, but the current expected outcome.

Read part two of this Analysis Of German Automotive Companies – A Series.

About the author

Alex Voigt has been a supporter of the mission to transform the world to sustainable carbon free energy and transportation for 40 years. As an engineer, he is fascinated about the ability of humankind to develop a better future via the use of technology. As a German, he is sometimes frustrated about the German automotive industry and its slow progress with battery electric vehicles which is why he started to publish in English and German. With 30 years of experience in the stock market, he is invested in Tesla [TSLA], as well as some other tech companies, for the long term.