Mercedes-Benz vehicles are the expression of ultimate luxury in the premium segment, but at the same time, it’s also one of two companies in Germany that I am seriously concerned about either losing their independence or even risking bankruptcy. Given the tremendous positive profit growth they had lately, such an opinion may sound wrong to most but it’s a conclusion based on data and facts. I will explain in this article why I believe that Daimler is in trouble and continuous shrinking, consolidation, or silent acquisition through Chinese investors may happen sooner than most expect.

The Past

Like all automakers globally and without exception Daimler didn’t believe in battery electric vehicles at first and made many strategic mistakes they still suffer from. But unlike all other legacy manufacturers, Daimler invested early in Tesla and ordered an electric drive train for the B-class which rescued the Californian company from an early bankruptcy. Without Daimler Tesla would likely not exist today. Despite its success, the Tesla project was internally not taken seriously because you could make more profit with combustion engines and as a financially and shareholder-driven company the decision was made to pull out and continue to sell the ICE – instead of the BEV B-Class.

Not only did Daimler end a precious Partnership that gave them valuable technology insights, they also sold their 9.1% Tesla company share they acquired for €50 Million, in 2014. A stake which today, would be worth about €100 Billion – more than the entire Daimler company’s and that incident contributed to the purchase of my first Tesla shares a few months later.

CEO Zetsche didn’t believe in battery technology and cell production and stated in 2014, “Cell production is a question of scale. It’s unlikely that will happen on a large scale in Germany.” Years later he left and was denied the usually given Chairman position because of the Diesel scandal and the many strategic mistakes that put the company lacking behind with BEVs in a challenging environment. One of those mistakes was the cell production that Daimler first declined.

Like most legacy automakers, Daimler decided not to commit to one route, instead developing several technologies in parallel instead of learning from the success of Tesla capitalizing on only the BEV business. The outcome is a company that is shrinking but invests in Hybrids, Hydrogen, Battery Electric Vehicles, and if that isn’t enough still into ICE technology. Precious investment is now divided into four different drive train technologies. Their decision resulted later in mediocre BEVs like the EQC model that disappointed customers with low efficiency and sales numbers or the Chinese Denza X, where only 4,000 units were sold.

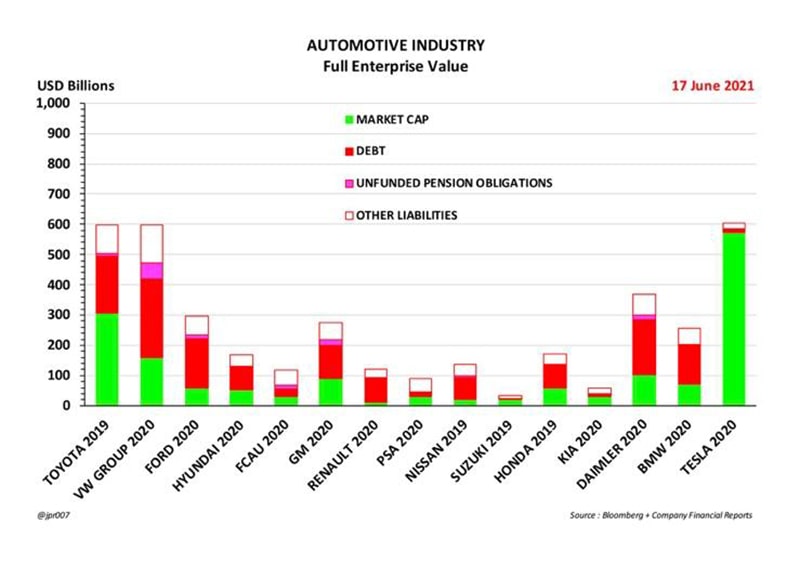

Financials

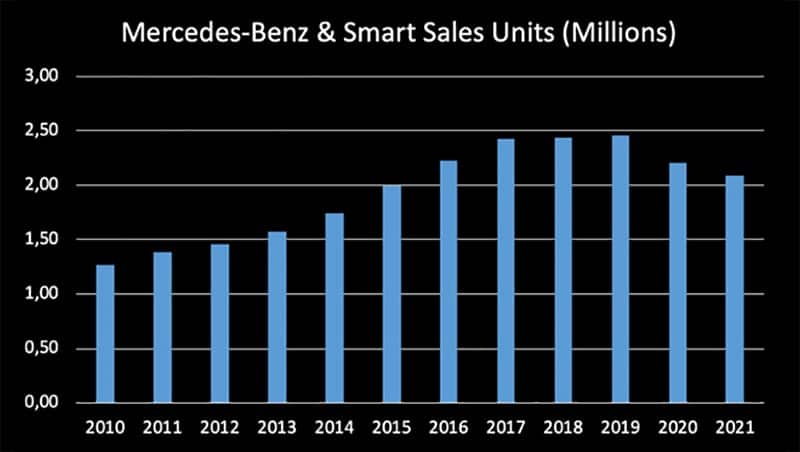

Profitability and cash flow are key components to keep a company independent and with shrinking ICE sales and a high-cost structure, Daimler decided on a new finance-driven CEO with limited understanding of technology. The new CEO Ola Källenius initiated 2020 a cost-cutting program and a new strategy to shrink the company profitably. An approach that makes sense, with around 2.5 Million vehicles sold per year and no clear decision towards a BEV transition at that time, the individual areas of the organization were too small to make decent profits and create the required cash flow. Up to €400,000 has been paid to employees for leaving Daimler at a time where Tesla started to search for Managers for their new Gigafactory in Brandenburg and quite a few took the money from Daimler and started with Tesla switching from a backward ICE-oriented undecided company to the undisputed global leader of BEVs with a nice bonus in their pocket.

Unbeknownst to many, Daimler split not into two but three parts with Daimler Mobility, a unit that does not make many headlines but is now cut in two for each new unit. All these measures have the one objective to keep the cash flow high and reduce the cost structure. By doing that the profit per vehicle grows and with that the Top Manager bonuses.

The pandemic years 2020 and 2021 included supply chain disruptions but still have been the best years for Daimler’s profit for several reasons. First of all the semiconductor shortages enabled Daimler to allocate the limited semiconductor supply to high margin premium vehicles, of which they did extensively. Secondly, price increases have been fast accepted by customers that have been waiting for their vehicle for a long time which helped to increase profits as well. Finally, due to periodic and continuing shift and plant shutdowns Daimler received government incentives for short work that reduced the high salary costs for unused workers to almost zero allowing unprecedented cost flexibility in a challenging environment. All of these three artificial factors together with low-interest rates result in the highest profit per vehicle Daimler ever made.

Despite decreasing unit sales, Daimlers quarterly profit results are high and dividends have increased which keeps shareholders happy and the stock price up. After each of these three factors is gone, the already shrinking ICE sales will continue to shrink and Daimlers success will depend on then on how fast the BEV models can compensate for them if at all. This includes BEV Models like the EQC, EQA, and EQS which are not successfully compensating the ICE A, C, and S-class yet.The 2022 EQS has been the only Model that hasn’t been heavily criticized. Despite this, as a premium luxury model, it will in any case only attract a very small buyer group and alone, does not guarantee the financial future of the company. What may look like a revenue and profit victory for Daimler in the last years might reveal to be a hidden Pyrrhic victory the company will eventually pay a high price for.

Innovation

Daimler has recently revealed the innovative EQXX concept with a stunning design and technical specifications including a range of 1,000km (621 miles) on one battery charge, but only a few took a deep look into what is the technology that has been presented. The audience gets during well-designed marketing presentations that use many buzz-words naturally, quickly excited and the impression that the company is ahead of Tesla as well as of all other BEV manufacturers. But when we review all described technical specifications in depth we see a summary of efficiency measures all automakers have either implemented already or plan for it. Each of Daimler’s break-through technologies are a collection of what other BEV manufacturers have done for years or developed already but none is unique or even new. To combine all of them into a concept car could be called new but prototypes are easy and mass production with low cost is hard.

In the fine print of the press release it is pointed out that the EQXX 1,000km claimed range is a result of a digital simulation. Everything works in a computer simulation if you define the conditions right, but a simulation is not the world we live and drive in, and it never will be, and if it were, all the breathtaking promises made by Daimler and other car manufacturers in the past would have come true. Did they? The EQXX is a concept and vision and nothing more while a Tesla’s Model S concept drove in Canada on Winter roads a few weeks ago the stunning distance of 1,210km on one battery charge.

The claims made by Daimler to shorten the vehicle development cycle need to be proven too because it would require a completely new internal as well as supplier reorganization we have not heard about at all but would if implemented. The challenges to change an internal and external organization, to improve development cycle times are massive and can’t be done without huge disruption while new start-ups have an opportunity to design R&D departments and supply chains from a blank sheet of paper. If it would be that easy we would have seen all legacy automakers develop a new model within 3 years already but we haven’t.

Quality

Instead of a faster development cycle, Daimler had in the last 2 months 16 different recalls of faulty vehicles in their millions.

It’s announced from Mercedes to build the entire powertrain for the new MMA and MB.EA electric architectures itself from 2024, a technology that is completely outsourced to suppliers currently. The know-how must first be built up internally, but with a development cycle of 7 years, it is hard to imagine the company being able to deliver the new, internally developed powertrain all of a sudden in less than 2 years.

To summarize, Daimler has presented a concept or vision for a vehicle that does not exist and if it would, its price would make it not affordable or a niche product even for people who are willing to pay a premium and all of that for a range the average person never drives without a stop anyway. As much as I want to believe that Daimler has achieved something outstanding with the EQXX if they had half of the presented technology available today their vehicles would be superior to a Tesla and the registration data reflecting that.

Autonomous Driving

The same is true for the Level 3 autonomous technology Mercedes presented with the EQS a technology that is essentially a lane-keeping and speed control assistant system at up to 60km/h (37 mi/h) on an Autobahn where the speed limit allows its real use only in a traffic jam or stops and go traffic. While many believe to call a system Level 3 is unique and the first autonomous driving ahead of Tesla, Mobileye, and Waymo most don’t know it’s just the liability that is taken from the automaker and not any technological innovation is implemented by its definition. Daimler presented a driving assist feature many automakers have in use for many years already but they call it Level 2 to keep the liability for now with the driver.

Considering that, Daimler and Mercedes-Benz have not presented any innovation nor a first autonomous functionality but simply the take-over of liabilities in a traffic jam and nothing more. Frankly said a Level 3 driving assist system is an easy task on an Autobahn where lane markings are usually very good and conditions are well defined without pedestrians and bicyclists unpredictable behavior.

To all who claim now, you can take your hands and eyes off the road with a Daimler S Class Level 3 system. Let’s understand that it may be slightly more convenient but other systems users do the same after they experienced for months and years how perfect their Level 2 system works in the described conditions. It’s a myth to believe users of Level 2 systems don’t do a lot in parallel and have their eyes on the road all the time. Nothing is unique with the S-Class Level 3 that marketing calls the ‘autonomous Mercedes system’ other than its legal liability status. The SAE Levels 1-5 do not define a technology maturity or capability but only and solely liabilities.

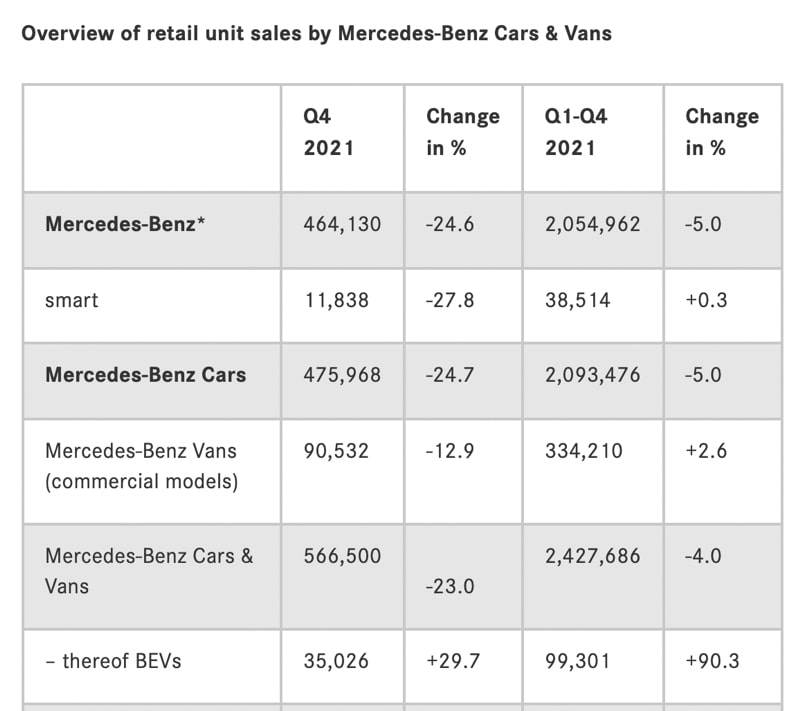

Vehicle Registrations

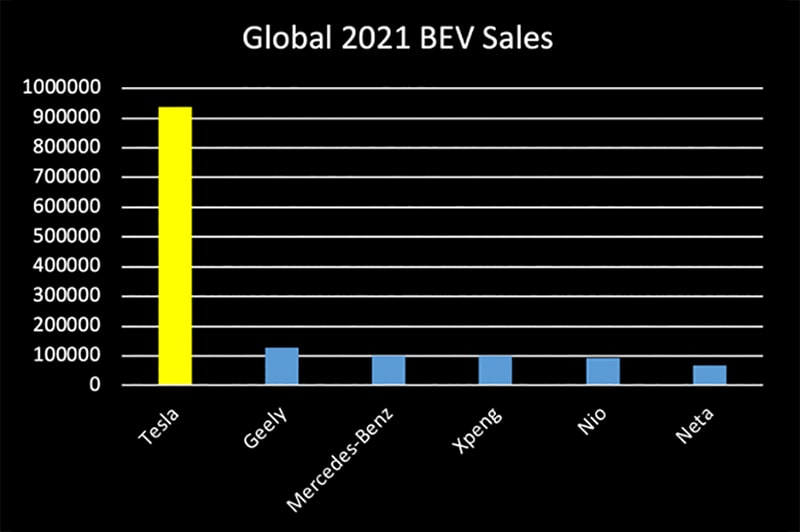

To summarize, the Daimler marketing department loves to push the idea that they are technology leader but if Daimler IS the technological leader that they claim to be, why are global sales numbers 2021 shrinking -5% and in Q4 even almost -25% year-on-year? Daimler BEV sales numbers have been growing to 99,301 units in 2021 if we add passenger cars, vans, and smart vehicles together which is great progress but this still keeps the iconic brand on the size of start-ups like Nio or XPeng who currently only sell their BEVs so far only in China a market where Mercedes-Benz has shrunk -2% while Nio and XPeng have grown by 100%. Mercedes-Benz is shrinking in total unit sales faster than the BEV growth can compensate and if that vicious cycle can’t be broken the company is positioned for many bad years with reorganizations, lay-offs, and underperforming financials, and stock price.

Supply chain issues and part shortages may explain some of the sales declines, but after two years, problems with components and systems remain. In 2020, it was said that the problems would end in the second half of 2021, and today the schedule has been pushed back to 2023. If all the problems had to do with supply chain challenges only, why is this the case even after new designed models are launched sales remain at low levels? Supply chain issues are a welcome explanation for legacy automakers but to claim they have high demand isn’t supported by registration data or customer surveys. Realistically, the supply chain challenges will remain but more importantly consumers are, with each passing month, increasingly less interested in ICE cars and more interested in BEVs.

Investors

The strength of a company can be read in the shareholder structure and during the Daimler, Truck IPO it was revealed that almost 20%, much more than previously expected, is now in the hands of two Chinese companies: Beijing Automotive Group (BAIC) Li Shufu, founder of the Chinese automotive group Geely.

Knowing that the Chinese market is because of its size of critical importance, 20% of the company is already owned by Chinese investors and more production localized in China we have reasons to be concerned that the iconic German Automaker is losing over time its ability to make independent decisions.

Daimler is the ultimate mass luxury brand and as such does historically well in Asia but the largest and most important sales region for the Stuttgart-based company is China. Despite this, a recent survey showed the majority of consumers said they would rather buy a Chinese luxury vehicle than a German brand. The results of this survey alone should make Daimler think very carefully about their position as a premium brand.

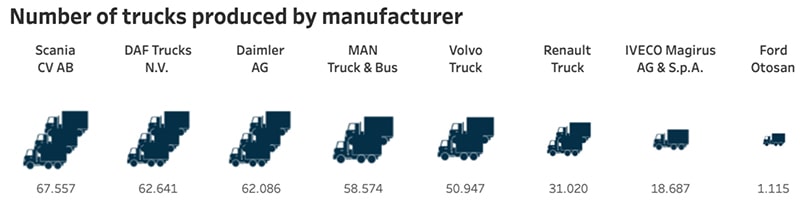

As previously stated, Daimler has been silently reorganized into three units, Daimler Trucks, Mercedes-Benz, and Daimler Mobility which makes the smaller units vulnerable for a take-over or even parts of it for an acquisition. Consolidation is ongoing in the truck business even before the first Tesla long-haul Semi-trucks are delivered to PepsiCo at the end of this month. While Daimler invests in Hydrogen and Hybrid Trucks the cost per mile for a full BEV truck will be lower and therefore more attractive for trucking companies.

Growth

In the last two years, Daimler grew its annual BEV sales by an additional 80,901 BEVs but Tesla by an additional 568,672 all of that while doubters claimed legacy automakers have a production advantage. The annual delivered BEV gap between the two automakers is not shrinking – it’s growing. This year or latest in 2023 Tesla will be larger in vehicle unit sales than Mercedes-Benz and larger in revenue and profit anyway. All this together shows that there is no real improvement over the last 3 years and it is hard to see how the company will transition from its ICE business to BEVs in a reasonable time frame without an existing cash cow product.

Prediction

My prediction about the future of Daimler, Mercedes-Benz Group and Daimler Trucks is based on the available information and data but may be completely wrong. The only justification I have to dare to make one at all is that the predictions I started to publish about 4 years ago and later turned out to be correct.

The likelihood that Chinese investors increase their Daimler share and define the future of the 120-year-old company is high. Daimler may be a brand that is owned by Chinese investors, a car has mainly in China manufactured technology inside and the remaining German contribution is the luxury interior design and Daimler logo on the outside.

The likelihood that Daimler Truck will be forced to merge or be taken over by a competitor without a tangible BEV truck in the heavy-duty and long-haul segment under development is high. Now that the company is listed on the stock exchange, a hostile takeover is more easily possible, and if no further consolidation takes place, financial distress is imminent. What does the future look like for a truck manufacturer investing in hydrogen and ICE trucks, while BEV costs per kilometer are factors lower, maintenance is almost non-existent, and autonomous driving functions you can license will also eliminate the driver of a BEV-Truck?

The likelihood that the passenger car business will continue to shrink is high, and the A, B, C, and E-Class will lose the majority of the sales they had in 2019. Chinese manufacturers and Tesla will compete with their core market segments, while the low-volume premium vehicle market will remain as the last bastion for customers wanting high-end luxury interiors.

The likelihood that Daimler will be dependent on external suppliers for batteries, software, and autonomous driving solutions is high and limits the company’s ability to shape its destiny and create required added value. The future profit creation lies in software and data and therefore the majority of profits will not come from Daimler but created by suppliers.

Of all the German automakers I’ve analyzed, Daimler is the one I’m most concerned about surviving the historic shift from internal combustion engines to software-controlled battery electric vehicles.

Read part one of this Analysis Of German Automotive Companies – A Series.

About the author

Alex Voigt has been a supporter of the mission to transform the world to sustainable carbon free energy and transportation for 40 years. As an engineer, he is fascinated about the ability of humankind to develop a better future via the use of technology. As a German, he is sometimes frustrated about the German automotive industry and its slow progress with battery electric vehicles which is why he started to publish in English and German. With 30 years of experience in the stock market, he is invested in Tesla [TSLA], as well as some other tech companies, for the long term.