The largest and most important industry of my country, the German Automotive industry is shrinking. They are shrinking for 3 consecutive years and a 4th is about to follow. Even worse, all information we have today shows us that the process accelerates.

My statement is based on hard data and facts and not an opinion. While people who read the news for instance about Q2 sales get the impression the German Automotive industry is doing well, is growing and positions for the future of electric vehicles if we dare to take a profound look into hard data we need to acknowledge they are in shrinking mode already for years. I’m writing this saddened that my mission in the last years to wake the German Auto industry up has failed.

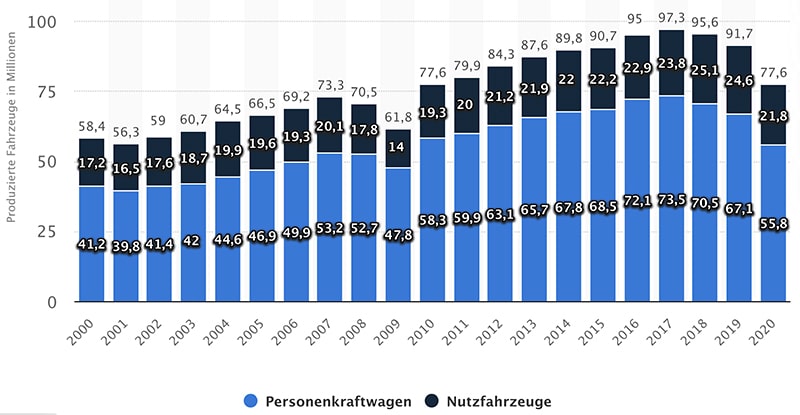

The global sales of all automakers shrunk from 97 Million vehicles in 2017 to 77 Million in 2020 (blue passenger vehicles, black utility vehicles). 20 Million fewer vehicles sold or an entire Toyota and Volkswagen group combined disappeared in just 3 years. Automakers try to explain production stops and low demand with the CoVid Pandemic in 2020 and the Semiconductor shortages in 2021 but the truth is that the demand for ICE vehicles continuously decreases. The marketing, PR and communication departments try to explain a global negative trend for legacy automakers while pure BEV manufacturers grew the same period by 50 to +100% annually.

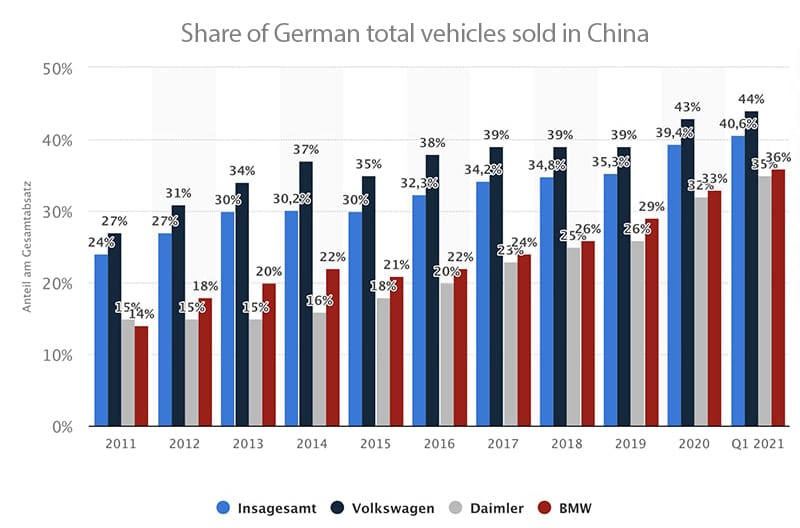

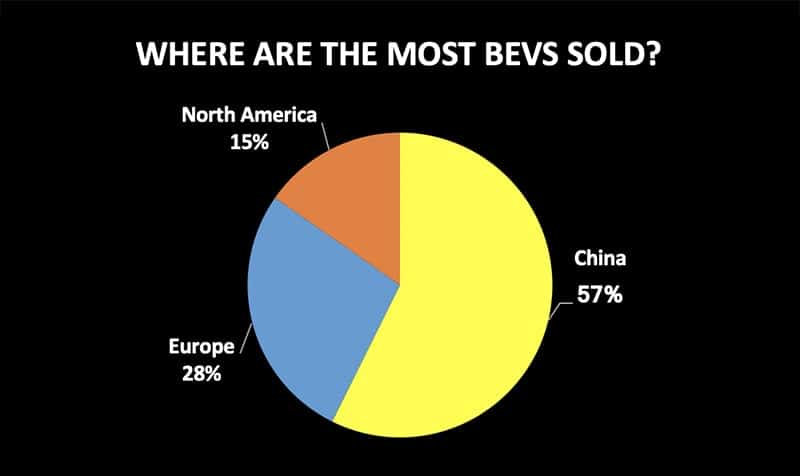

The most important market for German Automakers is China. Between 35% – 44% of the total sales of Volkswagen, BMW and Daimler in Q1 2021 was generated there. For a full decade that sales share grew without interruption year over year with ICE vehicles. Despite the Pandemic, semiconductor shortages or transition to battery electric vehicles the importance for revenue and profits relies on German Auto in the Chinese market and its continuous growth. A population of 1.3 Billion citizens developed a growing middle class that can afford to buy one of the most liberating devices and status symbols you can own – a car. We have passed the tipping point in 2017 where that development changed.

The traditional most important markets of German automotive companies in Europe and North America continue to be of importance but sales retreats and has been compensated from China growth. Regardless of good or bad quarters and years in North America and Europe the future depends on the extent the German premium manufacturers are able to create a loyal customer base in China like they’ve done in the last 100 years in the western world that continued buying their brand vehicles. Today all data we have confirms that they struggle to keep customers in the western world and are losing attractiveness and competitiveness in the world’s most important vehicle market in China that moves from ICE to BEVs.

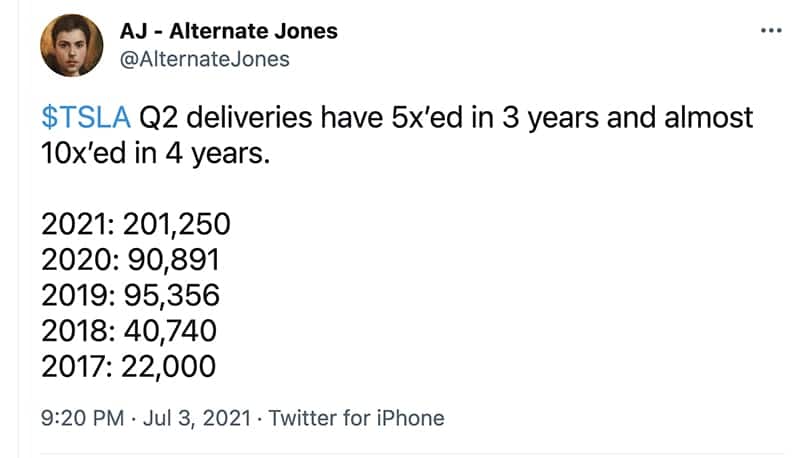

The German Ifo institute calculated that, “In the first five months of 2021, Germany produced only 63 percent of the number of passenger cars that it manufactured over the same period in 2018” . Compared with 2017 that number is even worse. While all automotive marketing departments compare with happiness their sales numbers to the exceptionally weak sales of 2020 where the pandemic made production, sales and delivery almost impossible, the unpleasant and undeniable truth is that a retreat of 37% in a time of recovery shows strong weakness. That -37% is happening while pure BEV manufacturers like Tesla grew between 2018 and 2021 by 400% or in average 130% each year and that in the 100s of Thousands.

China has announced like almost all other countries to abandon ICE sales over time and they support sales of BEVs with their growing automotive BEV industry. It’s an industry political strategy to gain influence worldwide by strengthening their ability to design, manufacture and sell Chinese made battery electric vehicles in all markets of the world. The most competitive Chinese BEVs are not yet available in Europe and North America making these continents for the time being still somehow a protected region for a legacy industry like German Automakers. The unavailability of enough good BEVs in Europe helps German Automakers to sell their brands be it in Germany or Europe but China and USA shows us how it looks in markets where competitive BEVs are available.

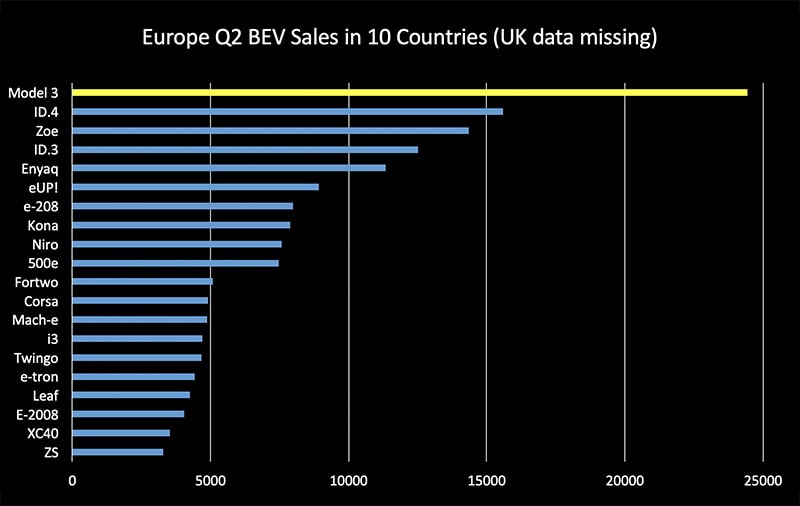

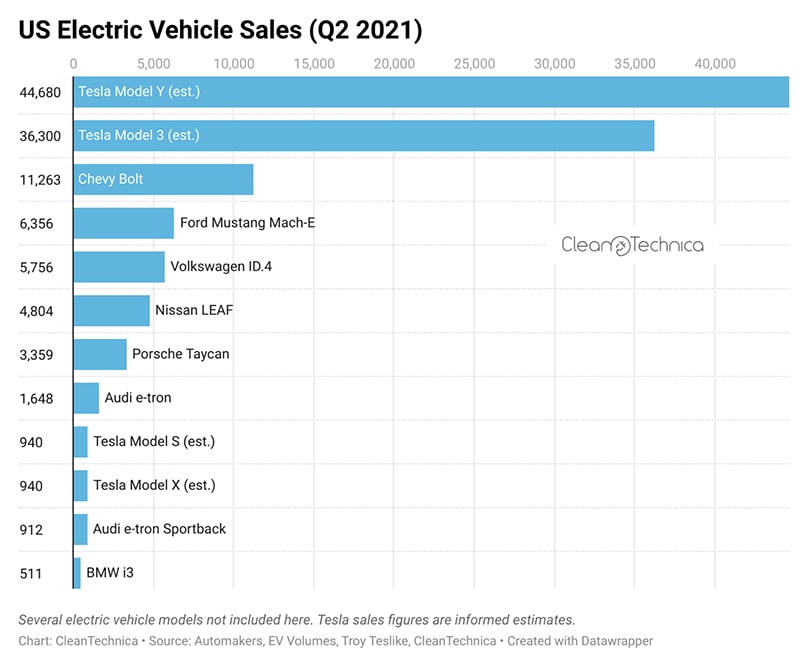

With the first Chinese BEVs entering Europe and North America the peaceful time for ICE and BEV sales is changing. The Model 3 imported from China is in Europe the bestselling BEV in Q1, Q2 and 2021 and first Chinese BEVs in Europe like the MG ZS EV capturing top spots in European markets like Sweden. VW claimed sales victory before in small markets like Sweden with strong ID.4 sales but lost against the Chinese MG ZS EV in June that pushed the highly-promoted VW model to the 5th rank behind the Model 3. All of these developments are happening while the Model Y which is better selling in markets than the Model 3 will start delivery in August 2021. The Model Y is the bestselling BEV in the world and will take a decent market share in Europe. In the US, the home market of Tesla, the poor ID.4 sales of 5,756 units in the first 6 months of 2021 makes it a small niche player compared with the Model Y or Model 3.

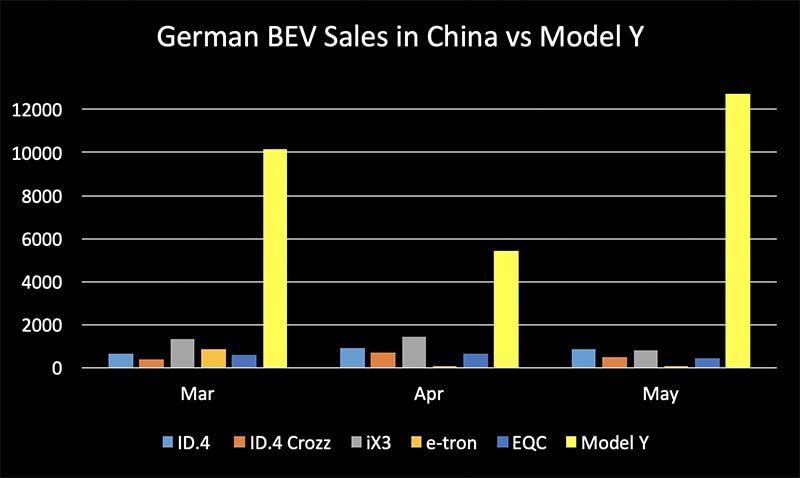

In May Audi only sold 50 e-trons in all of China, Volkswagen sold 847 ID.4’s and 504 ID.Crozz but Tesla managed to sell 12,748 Model Y. Volkswagen, Audi, Daimler and Mercedes-Benz selling in their most important market, China, with 40% of total revenue only a fraction of their BEVs but their share of ICE vehicles will inevitably shrink. In June latest numbers suggest a sales of 2,900 ID.X and ID.Crozz combined which is an improvement over May on a low baseline but the Models do not make it according to media sources even in the top 40 in China in June. The largest Chinese car portal Autohome.com counts only 2014 sales in June and the difference to 2,900 vehicles represents all delivered to VW Dealerships. A Manager in the Beijing office commented that this “caused a shock in the house.”

Shrinking revenue in China can’t be compensated in North America nor Europe because ICE sales are also retreating too and they currently struggle not to lose existing ICE customers to US and Chinese BEV manufacturers.

When Chinese customers are asked why they don’t buy a VW ID.4 the answer is often that they appreciate the design but the technology and digitalization is behind similar Chinese cars.

Chinese consumers are technology lovers and currently German Automakers don’t appear to have the capabilities and specifications of Chinese or Tesla BEVs. The MEB platform manufactured by VW is designed for use until 2026, it will have some small possible improvements until first vehicles from the new Trinity platform will be delivered.

5 years without significant improvements could damage the reputation and sales of VW in China and elsewhere. The same is true for the low-cost Audi, Skoda or Seat BEV models. Daimler and BMW have an even weaker BEV offering and won’t be able to compete against an agile and aggressive BEV start-up scene like the increasing offerings from Nio, BYD or XPeng. In China there are many other brands not familiar in the West yet who have already captured decent market share and positive brand value.

The China Passenger Car Association calculated that 57% of the global BEV market share is in China and a 40% Year-on-Year is predicted growth for the next few years. For Tesla, they expect a global market share in 2021 of 24%. Every company that doesn’t succeed with its BEVs in China will either shrink or remain a niche player in its segment.

While German Automakers have a great reputation with ICE in China their BEV reputation is heavily under attack. A good example is the faulty and not responsive software of the ID.4 and ID.3 with over-the-air software updates that have been delayed and are only partially updating functionality. As the ID.4 is based on the MEB platform and the software issues are partly due to steering systems and the vehicle IT Architecture there is no quick fix for that issue unless a completely new car is going to be designed.

Even VW starts to realize that the next big improvement cannot be expected before the Trinity platform is available in 5 years. VW R&D Head Ulbrich said recently, “The MEB is still too conventional at the moment”. Traditionally a new model takes VW 7 years to develop and launch and in their history 5 years is already an improvement. Vehicles built on the MEB include all IDs with the future ID.5 and ID.6 for the Chinese market as well as the Skoda Enyaq and the Audi Q4-e-tron to name just a few. In the next 5 years all mid and low-cost BEV’s from the VW Group will be from the MEB Platform and have the technical and reputational issues described previously and with it, the headwind with sales.

While VW focused on scalability and low cost with MEB they fall short on technology and specifications. Customers realize that and turn to brands like Tesla who are able to deliver a very different experience including a large and working charging network and ever improving vehicle with the promise to one day drive autonomously.

In the USA, the situation doesn’t look much better for incumbent automakers because Tesla and even US companies like Rivian or potential future players like Lucid take market share from German premium vehicles. It seems VW, Daimler or BMW have very little on offer to compete. The reputation has not only been damaged by the cheating device scandal, the more recent issue is that German BEVs are not state of the art in technology. The ID.4 was not well received in North America and the lack of working long distance charging networks together with efficient BEVs makes German Automakers a niche player in the BEV market while ICE sales retreat.

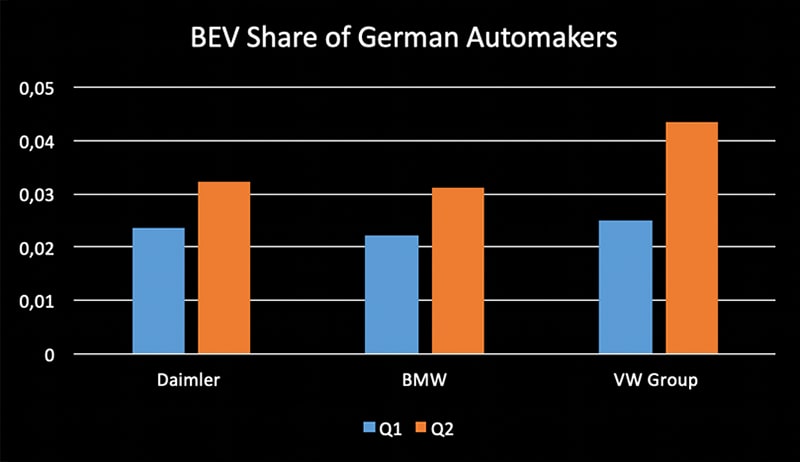

The Porsche Taycan is an example of a good German BEV but at its price point will only serve wealthy customers and will remain a niche product that takes sales from the 911 and Cayman Models but not from other BEV manufacturers. In Q2 Taycan sales were near 911 deliveries which shows how superior BEVs can be and with 12.9% BEV share, Porsche is an example for the entire VW Group that includes Porsche is in Q2 at 4.4%. A solid growth but without Porsche who pursues its own BEV strategy the VW Brand was only at 3.4% in Q2 – a BEV share of similar size as Daimler and BMW.

Even in their home market, Europe and Germany, the legacy automakers are unable to win back every ICE customer they lose, the rise of electric vehicles has changed brand loyalty to an unrecognizable extent which has resulted in shrinking sales across all types of vehicle. Daimler just announced to stay flat in vehicle sales in 2021 compared with the weak CoVid-year 2020.

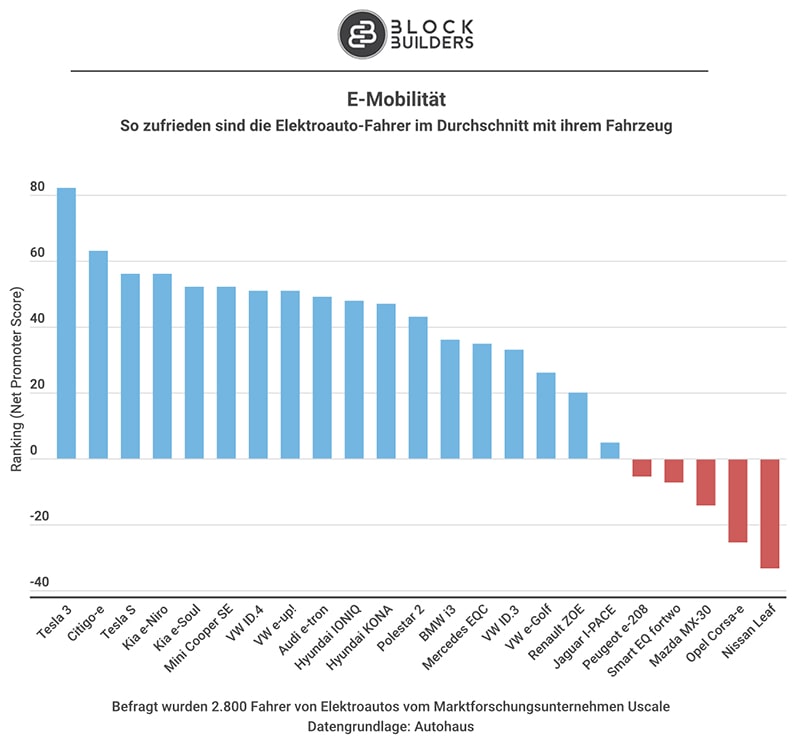

Tesla won with the Model 3, the bestselling BEV in 2021 again. The first Chinese built Model Y will begin deliveries in a few weeks and with local European production in Giga Berlin at the end of the year a new customer segment will leave their ICE vehicles and experience a Tesla. Customer satisfaction surveys have confirmed many times that consumers who once bought a Tesla don’t go back. The loyalty German premium automakers have relied upon and are familiar with but now it turns against them. A recent and representative German Net Promoter Score Survey which asked 2,800 BEV drivers is proof that Germans love the Model 3 much more than their German vehicles. With 800 Supercharger stalls added in Q2 and with now 1,000 Supercharger stations in Germany alone the satisfaction comes from the fast-charging network too.

The strong Q2 VW Group results are only strong if compared to the CoVid year 2020 but already weak with -7.2% if we take 2019, the much more realistic pre-Covid year, as the baseline to compare with. While many consumers could not order, nor get a vehicle delivered in 2020 they came back in 2021 as pent-up demand. But in total, 2021 demand is on a lower level.

In China VW lost -12% sales in Q2 and -21% in June of all vehicles which is a devastating result. The strong profits from German Automakers in 2021 are mainly a result of a strong workforce reduction that started in 2020 and Government short-work incentives helping with shifts and plants closing due to Semiconductor shortages. It’s not an organic strong profit or sales situation that German Automakers find themselves in, but an artificial one.

Another indication for the dilemma and severe situation is the used vehicle market. A used Tesla is hard to find and is almost as expensive as a new car while the amount of used German BEVs is high and their prices are low. Consumers are much smarter than many automotive marketing and PR experts believe and understand well where they get the most value for their money. Everything changes if consumers have a choice and more choices are available every other week. The ID.4 is now offered as a new car for companies in Germany with a monthly company car rate of €99 and private owner rate of €130 confirming the low value consumers consider the vehicle to have.

It doesn’t matter any longer if you manufacture and design premium ICE and PHEV vehicles you sold well in the past if your market is shrinking continuously. Regardless how good your cars are, if the market you sell into disappears a little bit more every year pretty soon your company will follow.

The only business that matters is the BEV business and if you don’t have a vehicle that has enough value and advantages for a consumer group it won’t sell well. German Automakers have difficulties selling their BEVs while pure BEV companies are growing impressively, approaching a million vehicles a year soon. Models that sell in the hundreds of thousands are required from German Automakers to scale and reduce costs per unit but they have so far not designed a single one.

Considering the huge amount of stranded assets, the question is what will happen to German Automakers? While they shrink faster in ICE than they grow with BEVs all of them have started to reduce their workforce to stay profitable. Daimler provides up to €400k packages for employees who leave the company and the CEO Källenius has publicly announced that Daimler will spin off their truck business and shrink as a company. VW makes their program encouraging older employees to leave the company more attractive by reducing the age limit to 59 years and has plans to offer good packages for 57 year olds soon.

Short term work and closed factories and shifts are announced every week right now, the German Government has given generous incentives for short term work and extended the BEV and PHEV incentives by 2025 helping the industry out of the financial mess they are in. VW sold the Bugatti Brand, it is rumoured to may sell their Electrify America charging network and a Porsche IPO is periodically discussed again. All of them are searching constantly for cash and the Q2 cash flow from VW Group is €10bn, about as large as the one from Tesla, a company that has 10% of VWs sales and a fraction of its facilities and employees.

While many claim that in particular VW Group is the largest BEV provider in Europe and well positioned to succeed, it’s worth taking a look at the BEV share per total vehicle sales. Over time all legacy automakers who intend to stay as big as they are today need to transition to 100% BEVs. Because PHEVs pollute and will be banned in many cities and countries too, they can’t be considered an electric vehicle. In 2020 VW Group had a BEV share of 2.48% and in Q1 it was 2.49% but they grew as a Group including Porsche to 4.4% in Q2 and VW brand to 3.4%. In order to keep their size, they need to replace 96% of all vehicles they make but the quarterly growth of the important VW brand was just 0.8%.

CEO Herbert Diess said at the strategy presentation in July 2021 that “By 2025, we should have a good chance of overtaking” but the registration data is proving that VW Group is falling behind. Daimler and BMW stand at 3.2% and 3.1% and to grow 97% of existing ICE and PHEV sales into BEV sales in 4-9 years seems unrealistic. Daimler grew BEV sales from 2020 to Q2 by 1.3% to 3.2% while average markets have a share of 10%. All of them need to grow that number for 5 years with 100% over the previous year to achieve the announced goals but right now their annual growth is close to 0%, -2% far below what is needed just to keep their current market.

The VW Group MEB platform has a global production capacity of 900,000 vehicles but sold in the first 6 months of the year only around 91,000 or 10% of it. 75% of that 91,000 have gone to Europe. With 44% of all VW vehicles sold in China but shrinking -12% in Q2 of 2021 and only 1% of VW BEVs sold in China the group is in a severe crisis. Their plan to sell 80,000 – 100,000 IDs in China in 2021 falls short with 18,000 delivered in the first 6 months. VWs Yield in China has for a long time been falling for the first time below 10%.

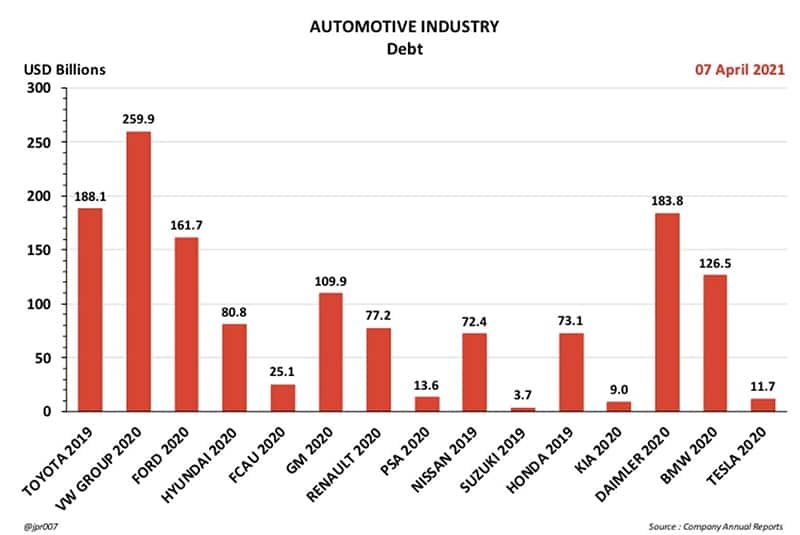

But the question is now what happens if they don’t change fast enough and create the urgently needed demand? During the financial crisis banks defined a spin-off widely called Bad Bank with all debt and liabilities to enable a fresh start and some automotive companies may decide to do the same. While they shrink, the burden of liabilities increases and although the German Government will do all they can to keep the 800,000 direct jobs alive a Bad Automotive Bank could help to ease the pain and open the door for new access to finance their business with the capital markets.

Many believe bankruptcy is imminent for many German automotive companies, but we may see an increasing flow of money from the EU Commission and the German Government to bail them out. VW Group may start to sell more assets and even take Porsche public with an IPO while BMW and Daimler may, in the near future, be brands that are not managed by German investors any more.

The German automotive brands still have a value but very sadly, with the current decision making at the top, that value decreases every day.

About the author

Alex Voigt has been a supporter of the mission to transform the world to sustainable carbon free energy and transportation for 40 years. As an engineer, he is fascinated about the ability of humankind to develop a better future via the use of technology. As a German, he is sometimes frustrated about the German automotive industry and its slow progress with battery electric vehicles which is why he started to publish in English and German. With 30 years of experience in the stock market, he is invested in Tesla [TSLA], as well as some other tech companies, for the long term.