Volkswagen presented at its ‘Power Day’ a planned future battery supply in Gigawatt Hours (GWh), as Tesla did the same half a year ago at its Battery Day in September in California. A day I had the honor to participate in.

Gigawatt Hours of battery supply translates into Battery Electric Vehicles (BEV) and residential energy storage or utility batteries revenue. The demand for EVs is high but the current bottleneck is having enough supply of batteries. Batteries are not measured in units but energy storage capacity or Watt-Hours. This article compares what both companies presented and who will be larger within, and at the end of the decade.

When an automotive company like Volkswagen presents their newest technology, you see well-trained Top Managers moving like actors on stage: everything they present sounds somehow exciting, positive, and just like an amazingly bright future. What is usually lost in these presentations is context and content about the relevance for the business and how it relates to customers and competition. The underlying thinking of the Marketing and PR departments is that the ‘average Joe’ listening won’t be able to understand it anyway. Therefore they tend to make key messages easy to remember. I believe that this kind of thinking is flawed and even very complex content can be explained in simple words.

There is no mistake, simplicity is hard and requires effort and profound thinking to explain complex technical details in an easy and understandable manner, yet still be correct and accurate. Explaining complex information in a simple but easily understood package is part of my mission.

The previous thought however, is true for every automaker including Tesla at the Battery Day and VW at their Power Day. Tesla tends to give a lot of details and content in presentations and unfortunately loses the audience quickly in translation with a lot of information. For Analysts, the information is vague: they can’t use their spreadsheets to calculate future stock predictions, and for journalists the information is often useless unless they have engineering backgrounds which is often rare. In contrast, Volkswagen’s presentations, where mostly German Executives read (to the best of their ability) heavily accented English directly from a prompter, Elon Musk and his team speak free without pre-written text but that doesn’t make it necessarily easier to understand.

People are not naturally experts in battery technology, artificial intelligence, or autonomous driving and want to get the one message that explains, all but technology is complex. Legacy automakers tend to stay very much on the surface when presenting but the latest VW Power Day was a positive and welcome exception to that rule. We have seen a company breaking with the past and presenting aspects of battery electric vehicles that matter for the future e.g. cost per unit or battery production capacity in GWh. Vehicle sales, revenue, and profits are all a part of the quotation that relies on the true bottleneck of the industry – battery capacity expressed in Watt Hours.

VW presented at Power Day their plan to build 6 battery factories across Europe before 2030 with an annual production capacity of 40GWh (in total making 240GWh). Besides Volkswagen, with its own planned Salzgitter battery factory in Germany, suppliers and partners like Northvolt will run facilities and supply too. It’s not known to what extent other suppliers are involved in the 4 remaining battery factories but it does not matter much because we know it’s 40 GWh each and that helps to calculate the total future output. To put this into relation, Tesla called their Kato battery factory that started last year with a capacity of 35GWh a pilot production plant.

VW introduced a new unified cell format for the Group that suppliers don’t manufacture and deliver today. Additional external supply from companies like Panasonic, CATL, or LG Chem has not been presented, and given the new cell, the format is not expected as of now. The media reported that the power day presentation of new unified battery cells hit the existing supplier base with surprise are credible. Allegedly, VW even denied meeting them after the presentation as they asked for clarity about the future and what role they will play.

For that reason, we must assume that VW will abandon previous cell suppliers and attempt to assure their supply through their own facilities which in total are the 6 European factories previously mentioned, with a planned total capacity in 2030 of 240 GWh. Other VW manufacturing sites e.g. Chattanooga in the USA is planned to be supplied from external supplier at least for the next years but more information about VWs Group strategy concerning North America and Asia is not known.

In contrast, Tesla presented to produce its battery formats e.g. the 4680 in-house as well as with external suppliers. They made clear that they take all volumes supplier can deliver. Elon Musk also informed viewers that the Battery factory near Berlin in Brandenburg will be the largest in the world and supply all vehicles produced for Europe. Many years ago, he also explained in a presentation that batteries are transported 4 times around the globe before used. That creates a really bad carbon footprint therefore batteries should be produced where the end product is sold. Since that day, he executes on that plan and sources material if possible near production of batteries and near vehicle and stationary battery manufacturing.

At Tesla’s Battery Day in September 2020 they explained their plans to deliver 3,000GWh by 2030 out of their own production globally. Those volumes are produced by Tesla and on top, they want to purchase all batteries their supplier can possibly deliver.

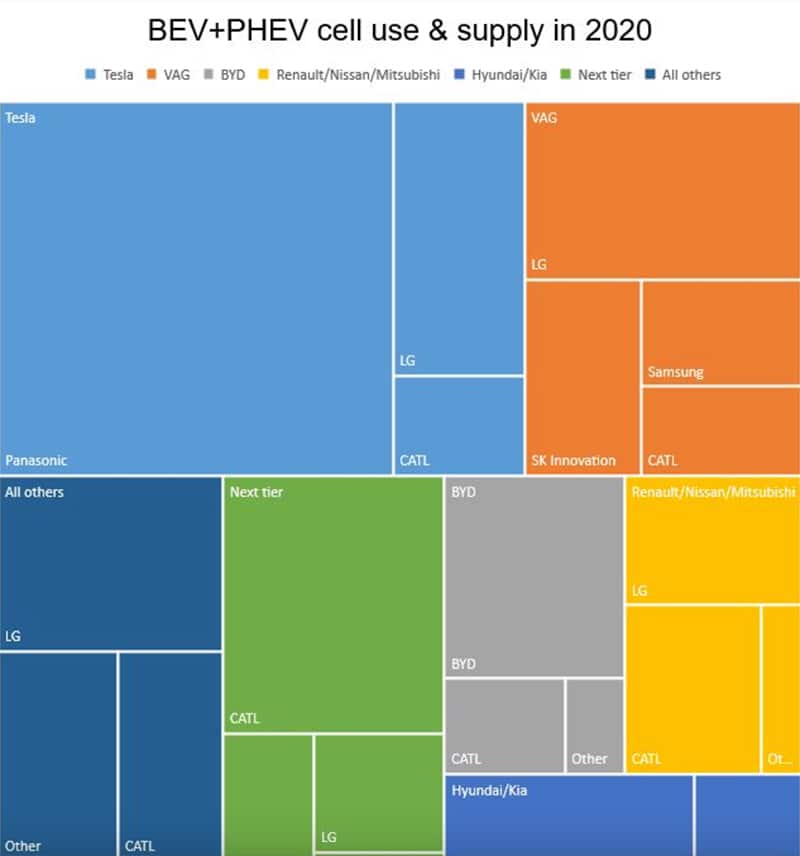

Before we take a glance in the future let us get a solid understanding of how the automakers purchased or produced batteries compares in the past. In the year 2020 adding all available information together, Tesla battery supply was the largest in the world and translated into Tesla as the largest BEV manufacturer globally. While many look just at vehicle unit sales the truly much better metric to evaluate a company is KWh in battery supply because the bandwidth of KWh in each EV is wide. A vehicle with a larger battery is more expensive therefore the revenue implications are included.

What we see in the below chart is that not surprisingly in 2020 Tesla was the largest battery-consuming automaker in the world and VW is second. For VW to overtake Tesla it would need to produce, source, and deliver more KWh to consumers than Tesla plans in the future. If VW doesn’t do that they will never catch up.

Tesla represents in 2020 30.4% of global BEV+PHEV cell consumption with 36.4 GWh (34.40GWh for BEVs and 2 GWh stationary batteries).

Courtesy David Sharman. Source: www.sharman-associates.com

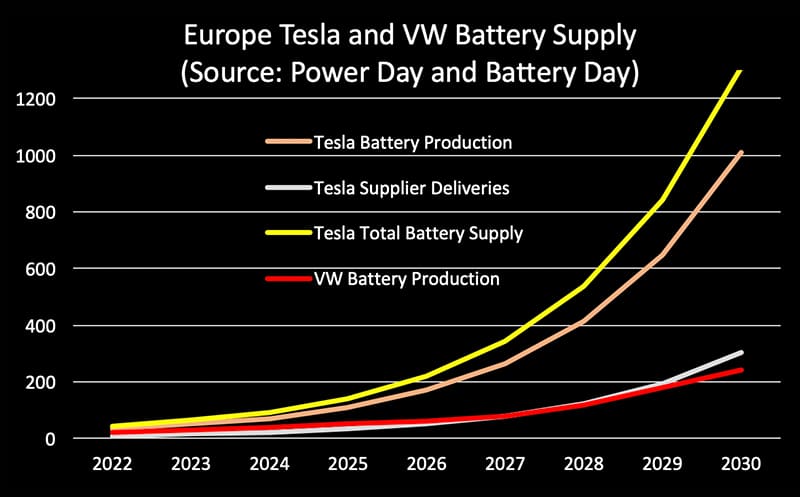

For the purpose of a fair comparison of the two automakers in their future battery production and deliveries we define the following assumptions:

- Both automaker achieve the claimed GWh production they presented

- We only compare Europe as the VW battery supply outside Europe is unknown

- An exponential production ramp is assumed for both companies

- The demand of end products for both companies outpaces supply

- A conservative 30% supply for Tesla from companies like LG Chem, CATL, and Panasonic

- 1/3 of the 3,000GWh (3TWh) Tesla presented for 2030 are used for Europe

- VWs PHEVs and Hybrids are included

If we just look at Europe, Tesla is not only today much larger than VW but in the future their lead will grow exponentially. In 2030 Volkswagen will according to their plan in Europe be about 18% of Tesla in GWh supplied and with that also in the respective revenue range. ICE revenue is not included because in our scenario we expect as presented from Tesla and VW that electric vehicles have won and ICE cars will over time phase-out. When that will happen is not known but what matters is that the EV share will grow and the ICE share shrink.

Ark Invest the Analysts that predicted Tesla’s success in the past accurately commented on the VW Power Day in their latest newsletter with:

“Tesla’s stated goal for 2030 is three terawatt-hours of annual production, 12.5 times more than VW’s 240 gigawatt-hours. In an exponential world, companies thinking linearly could be left behind.”

While VW only presented the 240GWh for Europe and Tesla its 3TWh globally the distance between the two may be even larger because Tesla could take up to 100% additional supply from external companies like they did in the past and VW may rely on its 6 European battery factories for all markets. For our comparison, I used conservative assumptions in particular for VW by assuming the 240GWh are for Europe only.

The media reports since the Power Day that Volkswagen will overtake Tesla quoting German Auto experts like Prof. Dr. Dudenhöfer from the CAR Institute “If things go well, the VW Group will be the world market leader in electric cars in 2022″.

The facts speak against the statements of the quoted experts and the response to my request to explain this contradiction shows that probably a gut feeling was the driving factor of Prof. Dr. Dudenhöfer rather than a scientific conclusion based on data. If this is the case, the question arises why the media publish statements that have no relevance as a basis for evaluation.

Data, science, and facts we all have access to prove that the Volkswagen Group is not anywhere near to challenge the market leader in size today and in the future. The Volkswagen group is today smaller in EVs and House batteries and will be based on their definition shrink every year relative to Tesla.

While I applaud Volkswagen’s effort to invest heavily into EVs, what they plan for is too little, and too late to become a credible challenger. My prediction is that Volkswagen will fall further behind Tesla.

About the author

Alex Voigt has been a supporter of the mission to transform the world to sustainable carbon free energy and transportation for 40 years. As an engineer, he is fascinated about the ability of humankind to develop a better future via the use of technology. As a German, he is sometimes frustrated about the German automotive industry and its slow progress with battery electric vehicles which is why he started to publish in English and German. With 30 years of experience in the stock market, he is invested in Tesla [TSLA], as well as some other tech companies, for the long term.