Seven months that shook the world? Or have the aftershocks barely begun?

As we emerge slowly – very slowly in some cases – from the fog of uncertainty, we can just about make out the outlines of what the world will look like when we eventually overcome Coronavirus.

So many industries will be irreversibly disrupted by the deep structural changes that COVID-19 will bring about, but the early signs are that amongst the hardest hit will be the manufacturers of combustion engine vehicles.

In full lockdown it was plain to see that cars, and their consequent air pollution, all but disappeared, and at that stage some speculated that populations the world over would ‘ditch their dirty diesels’.

Yet, no sooner had the lockdown loosened, commuters, wary of the infection risk that public transport posed, returned to private vehicles, and in larger numbers.

Furthermore, after three months with next to no sales, anecdotally at least UK dealerships have benefited from some short-term pent up demand.

But if you look too closely, you can easily miss the bigger picture. Much better to stand back and look at the longer term trends at play.

Markets the world over are seeing an accelerating uptake in pure electric vehicle sales, take Norway for example where EV sales (BEV + PHEV) amounted to 66% in June 2020 (with two thirds from full electrics).

While this is well-known as an early-adopting market and could potentially be explained away as an outlier, this trend is starting to gather pace in several other markets too, including the Netherlands, Sweden & Iceland.

SMMT latest sales figures for the UK in June show plug-ins at 9.5% (again two thirds from full electrics), exceeding hybrids at 7.0%, in a market that is down by 35% year on year.

Globally, while carmakers have had an understandably quiet Q2, TESLA delivered more than 90,000 cars, and almost certainly delivered their fourth consecutive quarterly profit into the bargain.

And all of these trends are before we factor in any economic downturn*, increase in telecommuting or any negative attitudinal shift away from combustion engine vehicles.

*Global car sales dropped from 73 million to 62 million per year in the wake of the 2008 ‘credit crisis’ and analysts believe that the 2020 crisis will be more profound and more prolonged.

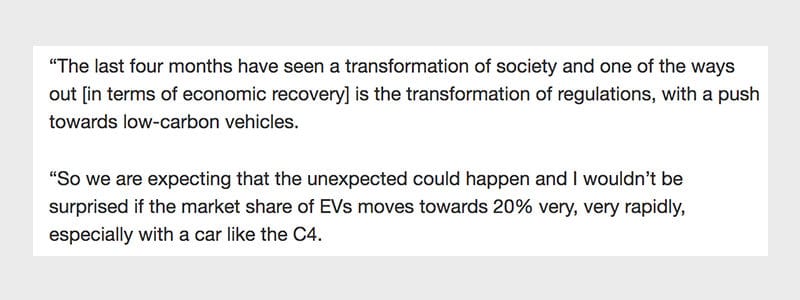

At the launch of their e-C4 Citroen boss Vincent Cobee said what many of us have been thinking:

In a recent snapshot survey, Fully Charged uncovered some interesting information, not least on changing behaviours around buying cars online (and Fully Charged’s incredible influence on decision-making).

To receive a free PDF of the snapshot survey email commercial@fullycharged.show

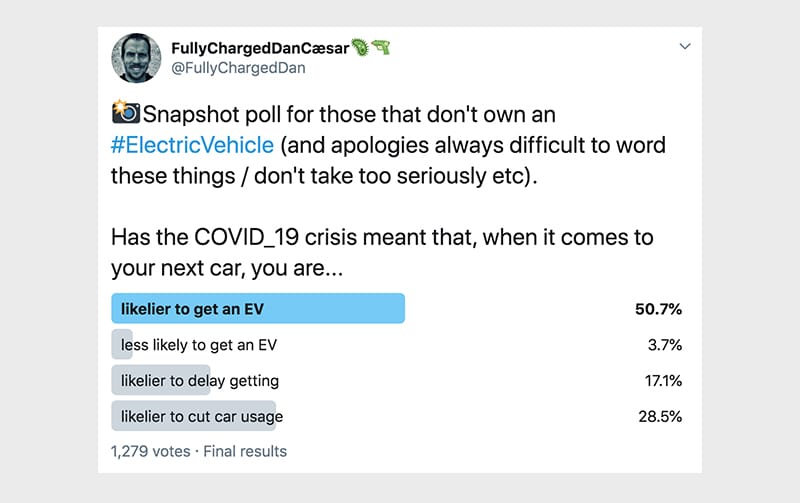

And while it is about as unscientific as it is possible to be, a straw poll that we conducted on Twitter at the weekend further indicated that those that follow the market but do not own an EV, also scent change in the air:

It’s too early to know, and it’s certainly too painful for the thousands upon thousands that have lost loved ones to make glib pronouncements, but maybe Coronavirus will provide the cure for another of the world’s ills, ‘car owner virus’.

It’s not sustainable to increase car sales indefinitely, and there are so many electrifying options now, with scooters, skateboards, bikes, trikes, mopeds, motorbikes, that maybe our love affair with the car is set to cool.

It gives us no pleasure – in fact it’s our sincere hope that the people within the car industry can continue to thrive – but a difficult decade for the car companies themselves is starting to look like ’emission impossible’.

But on the brighter side, we have a rare opportunity to reinvent the world in which we live, and for those that are ready to think outside the box, and embrace EVs of all shapes and sizes, there is a clear path forward.