How can you drive a new electric car (or van) for a few hundred pounds per month rather than having to pay the full upfront price of many thousands? The answer is by leasing an EV, and this is a guide to how it works.

We’re now in the process of a huge shift to electric vehicles, and very soon, more and more of us will be driving around in cars that have zero tailpipe emissions, which will be much better for local air quality, as well as helping in the fight against climate change. But to ensure that the maximum number of motorists are driving EVs as soon as possible, EVs need to be as affordable as possible, and this is where leasing can really help.

How much does it cost to lease an electric car?

EVs are often seen as being more expensive than petrol cars, but if the upfront purchase price is spread across monthly leasing payments, and if the fuel saving costs are also taken into account, then a new EV could cost the equivalent of less than £200 per month.

Monthly rental prices range from around the £150 mark for a smaller city car like a Smart fortwo or forfour, and range all the way up to £1,000+ for a Porsche Taycan or a Tesla Model X or S.

Smart fortwo electric cabriolet (left), Tesla Model S (right)

Benefits of leasing

Availability

Buying an EV second-hand for a lower cost is becoming easier, but there are still relatively few second-hand EVs around. So leasing can be an affordable way to drive the new car that you want. Another benefit of leasing (this is a side benefit but stick with us because it does make sense…) is that it creates a lot of used cars; EVs that business and individuals lease now will be available in the second-hand car (and van) market in a few years’ time. This is great news for EV adoption because not everyone wants or can afford a brand new electric car, so generating used cars definitely helps make electric motoring more accessible.

No risk on vehicle depreciation

Leasing of EVs is very popular, and one reason for this is because many people are wary of buying an EV outright. This is for a range of reasons, including concerns about depreciation. However this concern has proven to be unfounded, and EVs now have much better residual values, which means that the monthly payments are less. It’s also likely that petrol and diesel cars will become more difficult to sell, and so their residual values will reduce, as increasing numbers of Clean Air Zones are introduced around the country, along with other legislation.

Don’t miss out on improving technology

At DriveElectric we find that many of our customers prefer to lease rather than buy EVs because they expect that battery technology will continue improving over the coming years. Leasing rather than buying means that you can switch to an electric car with improved range or batter technology at the end of your lease. We’re definitely living in a time when more and more people see the benefits of renting a car rather than owning one.

Affordability

Paying a small monthly lease for an EV rather than paying thousands of pounds upfront to buy one outright makes sense for individuals, but it also works for businesses, as it makes accounting easy and budgeting much more straightforward. This works really well for vans, and of course company car drivers benefit from zero percent company car tax in 2020/21!

Types of lease

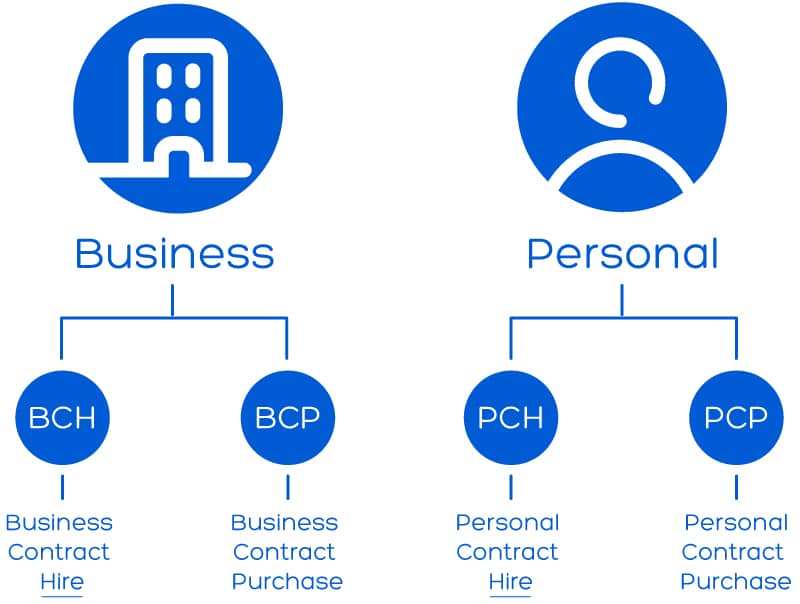

The term ‘leasing’ is an umbrella for a range of products, for a start there are different contracts available for both businesses and individuals (we call these ‘business’ or ‘personal’ contracts).

There are also different lease types: ‘Contract Hire’ and ‘Contract Purchase’.

Contract Hire:

Personal Contract Hire (PCH) and Business Contract Hire (BCH) are long-term vehicle rental agreements. You pay for the use of the vehicle throughout your contract, then return the car to the finance company at the end of the agreement without any further obligations. You will never own the vehicle as there is no option to buy it. This is the type of leasing we do at DriveElectric. The good news for businesses is that with BCH if you are a VAT registered business you can reclaim some or all of the VAT on the monthly rentals. Also the lease company is allowed to reclaim the VAT on the car when it’s bought new (normally you can’t reclaim VAT on purchase of cars but you can on vans) so the interest element is lower meaning lower monthly rentals for the business or individual.

Contract Purchase:

Personal Contract Purchase (PCP) is a popular finance option for customers who want to own the car but can’t access sufficient funds to pay for the new car outright upfront. You pay an initial payment, followed by a series of monthly payments for an agreed duration. The interest charged is calculated at the beginning and is fixed for the length of the agreement. You then have the option to purchase the vehicle at the end of your agreement at an agreed additional cost. If you are a business there is no VAT in these payments. You can reclaim 100% of the cost of the car against corporation tax in the first year, but be aware you’ll have to pay back the tax on the sale price of the car if it goes back to the lease company or you sell it later.

How leasing works

As well as choosing an electric car (and there’s lots of choice!) you’ll also need to decide how long you want to have the car by picking the term for the lease; 2, 3, 4, or 5 year lease contracts are available. You’ll also need to specify your annual mileage, this could be anything from 5,000 – 30,000 miles per annum.

Then select how much you want to pay upfront, with a Contract Hire lease this is your ‘initial rental payment’ (it is not a deposit because it is not refundable). You pay it at the start of your lease as your first monthly payment and it forms part of your overall lease cost. Although paying a higher amount upfront does not reduce the overall total you will pay it does reduce your ongoing monthly costs.

Once you’ve chosen your vehicle and rental profile you can get a personalised quote based on your selected terms. When you’re happy with the quote a contract is made and once signed your vehicle can be ordered (and you can put your feet up until delivery day). Your car will be delivered to your home, unless you’re opting for a Tesla, in which case you’ll generally collect your car from Tesla direct (there really is an exception to every rule!).

Once you reach the end of your lease with ‘Contract Hire’ leasing (what we do at DriveElectric) you simply hand the car back and choose your next EV.

Where can you lease an electric car from?

Most leasing deals that you see online are from brokers; a leasing broker is an intermediary who sits between the customer, car manufacturers (eg. Tesla) and vehicle funders (eg: Lex Autolease). Typically, broker deals are competitively priced as they scan the whole marketplace for the best offers for their customers.

An advantage of going through a broker (such as DriveElectric) is that they often have long and well-established relationships with the major funders in the leasing sector. So, as well as getting the right electric vehicle for you, you’ll also receive the best possible funding solution, tailored to your specific needs.

You could also go direct to the manufacturer for a car lease, either by walking into a showroom, or buying online.

What’s included?

Your monthly payments include the car itself and road tax (VED), although currently all 100% electric cars and vans are exempt from this. You can choose to have vehicle maintenance included or not included in a lease deal. Of course maintenance costs of EVs are also lower than those of petrol and diesel cars because they have far fewer moving parts, their powertrains are essentially just a battery and electric motor – much more simple, much less to go wrong!

Adding a maintenance package to your lease will increase your monthly payments slightly, but means that you won’t be faced with additional bills during your contract.

What’s included in a maintenance package?

- Routine servicing of your lease vehicle throughout your contract

- Vehicle repairs (including parts and labour) which have failed or worn out as a result of normal wear and tear

- Tyre replacements and repairs as a result of normal wear and tear

- Roadside Assistance

- MOT (if required)

What’s not included in a maintenance package?

- Windscreen and glass repairs and replacement

- Damaged, missing and stolen items

- Mis-fuelling

- Damage caused by road accident

- Accidental damage and faults caused by the driver

- Excessive driving style and driver-induced faults

- Consumables

- Tyre repair/replacement for damage caused by theft, vandalism, road accidents or neglect

What’s not included in a lease?

Insurance

Motor insurance is not included in leasing contracts. It’s the driver’s responsibility to insure their shiny new EV. For a leased car you will need a fully comprehensive policy and if the car or van is for business use then it will need to be insured for work purposes too. We suggest using comparison sites to find an insurance provider to suit your needs.

A home charge point.

Although not included in your lease contract, from time to time there may be offers available for free miles or a home charge point from energy companies, vehicle manufacturers or even your leasing broker. But the fact remains you will need to charge your car up, and we recommend you have a home charge point installed to do this. There is currently a government grant available to cover some of the cost of this. Charging at home is still the most convenient and cost-effective way to ‘fill’ your battery.

Plugging in a Kia Soul EV to charge up at home

Things to be aware of when leasing a car or van

Potential additional charges:

Like any financial product there are certain things to be aware of with leasing. As well as deciding how long you want the lease for, you’ll have to choose the annual mileage allowance that you think you’ll need, and at the end of the contract there will be charges for any excess mileage. There will also be charges for any damage to a leased vehicle beyond fair wear and tear. And if you want to end the agreement early there will be a penalty (but this is usually true if you have to sell a car early anyway).

Credit checks:

Again, a lease is a financial product and to ensure brokers and funder are acting responsibly in selling these products you will also be subject to a credit check. This demonstrates to the funder you can afford the monthly payments and applies to both personal and business customers.

About DriveElectric

DriveElectric has been in the vehicle leasing space for over 25 years, and since 2008 for electric vehicles, when we funded the first Tesla Roadster in the UK – and now EVs are all we do! We provide lease options for all makes and models of electric cars and vans, and provide support throughout the leasing process including:

- Charging advice and grant signposting

- Calculating the true cost including tax benefits etc for your move to an EV

- FlexiHire low commitment car and van leasing (from 3 months) to allow businesses to experience for themselves why EVs are better to drive

- Practical ‘real-world’ fleet reviews, focusing on vehicles with lower whole-life costs.

DriveElectric is looking to add in chargers, solar and batteries in the future in our continued efforts to make all low carbon technologies (LCTs) easier to own.

About the author

Mike Potter, Managing Director and founder of DriveElectric, is a thought-leader and innovator, always exploring new ways to support the UK’s transition to ultra-low carbon transport. Mike has a passion for EV technology, and has been involved in pioneering research projects (including ‘Electric Nation’ and ‘My Electric Avenue’) to investigate the effects of mass EV charging on the energy supply infrastructure.